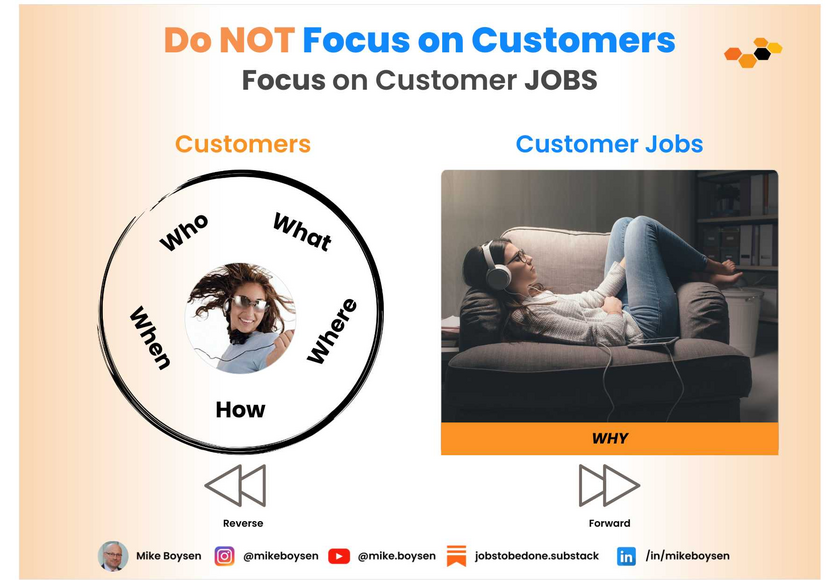

Technologies come and go, but the perfect market should be stable over time. To accomplish this, I suggest we use a lens that is "solution-agnostic." This will allow us to expand the scope of the market in such a way that opens doors to new value-creating opportunities.

For Example: All Enterprises participate in a single, highly-abstracted market. They are trying to achieve sustained profitable growth. Therefore, Enterprises trying to Achieve Profitable Growth is a market.

This sounds more like an objective than what we currently think of as markets, right? However, in the minds of customers, the objective is their ultimate motivation, and their job-to-be-done. As "solution providers", it should be our motivation as well. If we could deliver a single solution, platform, or appliance that enabled companies to achieve profitable growth, every serious executive would find the budget for it.

While this market focus is at such a high level of abstraction that it currently has little value for product developers, it demonstrates a key characteristic — the definition is stable over time. If we look at markets this way, we can better understand why products come and go. In fact, we should be able to predict their characteristics in advance; which in turn will help us evaluate new ideas that will undoubtedly emerge.

Understanding the sub-objectives within a market and the metrics that define solution performance are the keys to successful market strategies.

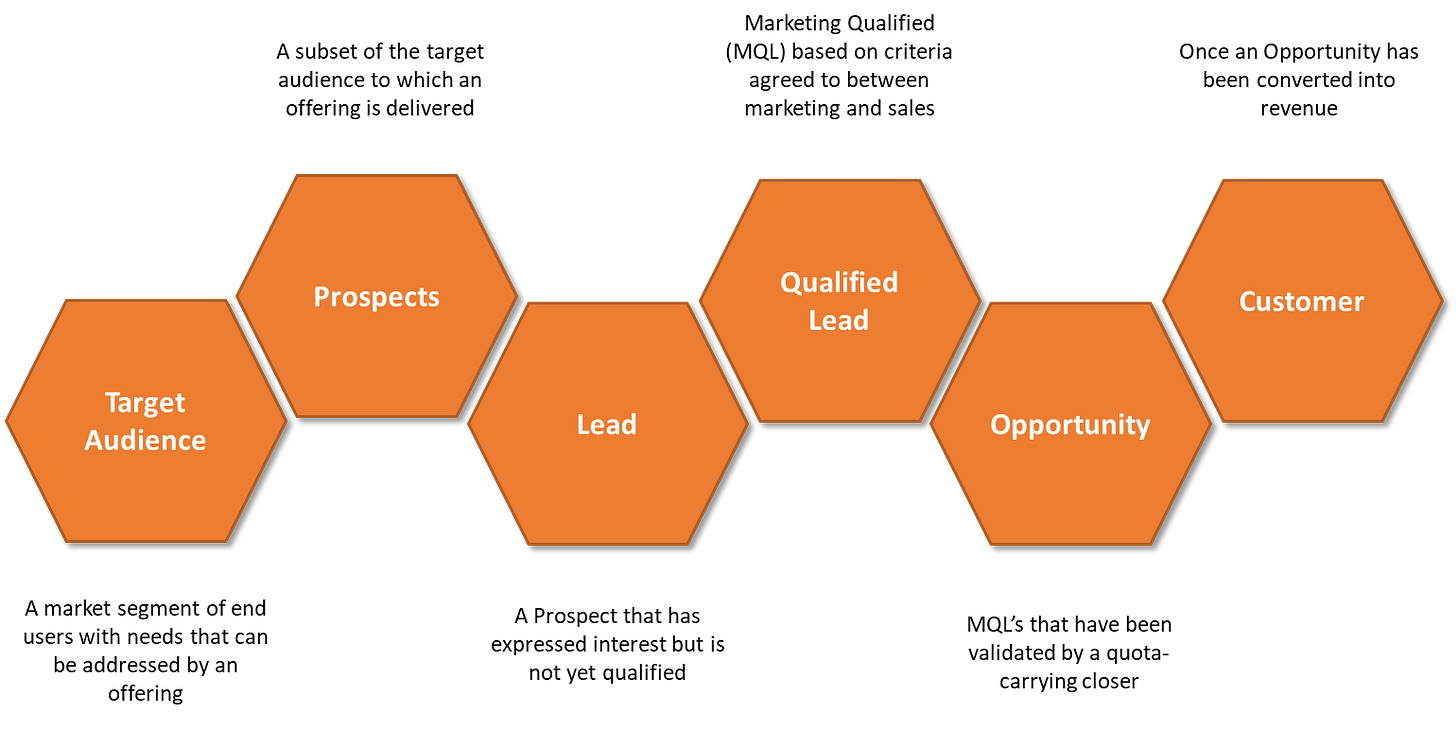

Let's Rationalize Our Marketing Definitions

I’m as guilty as anyone when it comes to misappropriating terms either out of convenience, or ignorance. I plan to use some marketing terms in ways that you may not be comfortable with. Therefore, it is important that I establish what I mean up-front.

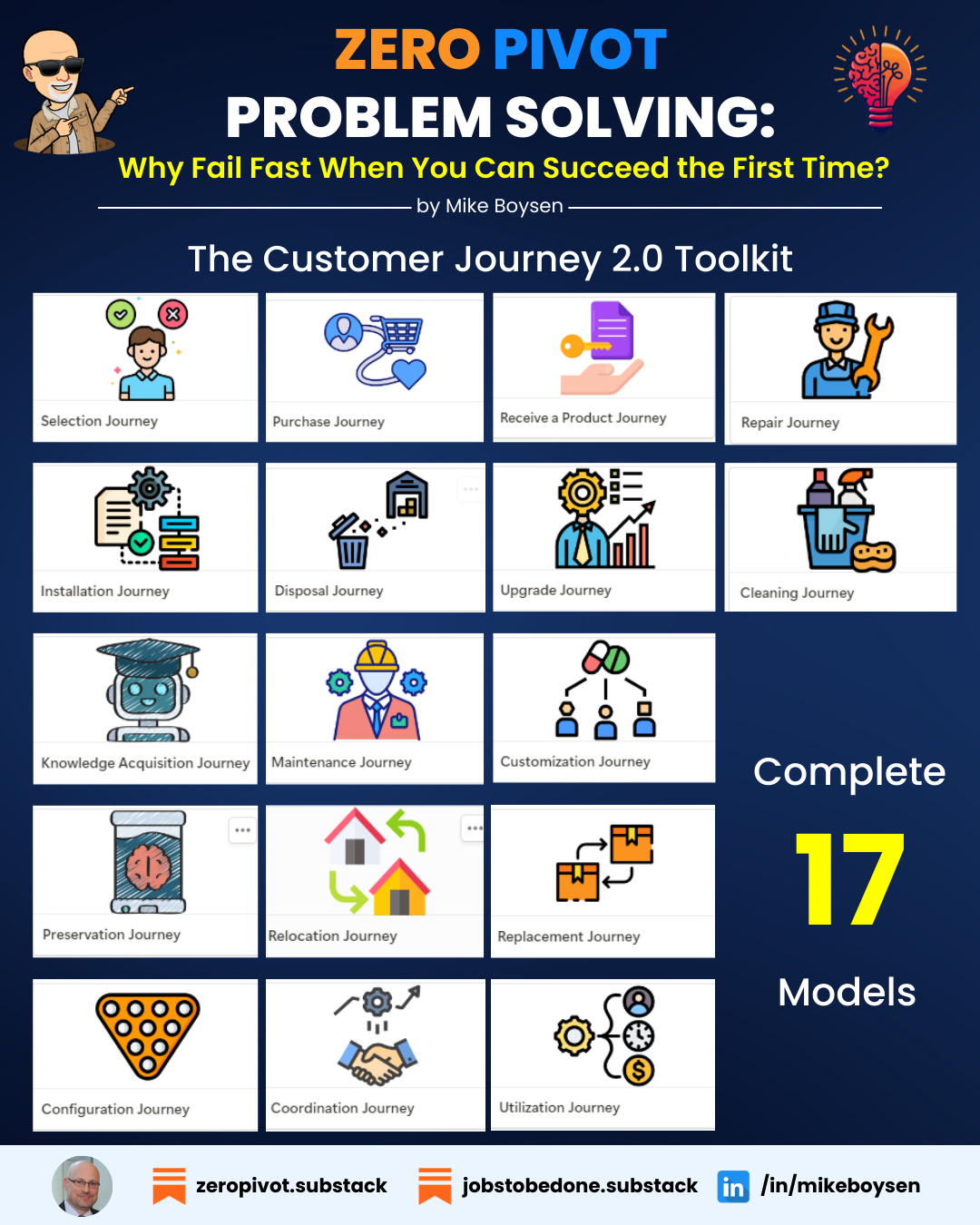

I consider revenue development to be a component, sub-objective, or value-driver necessary to achieve profitable growth. Companies follow this set of journeys to create revenue (as opposed to products). It can operate across a handful of modes as well; e.g., growing existing customers, retaining customers, etc. We’ll dive into that some other time.

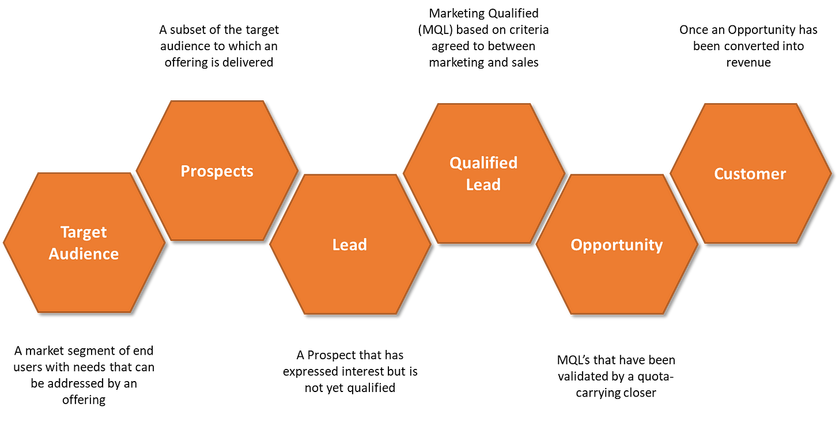

For additional clarity, I’m assuming the following progression about the state of the customer.

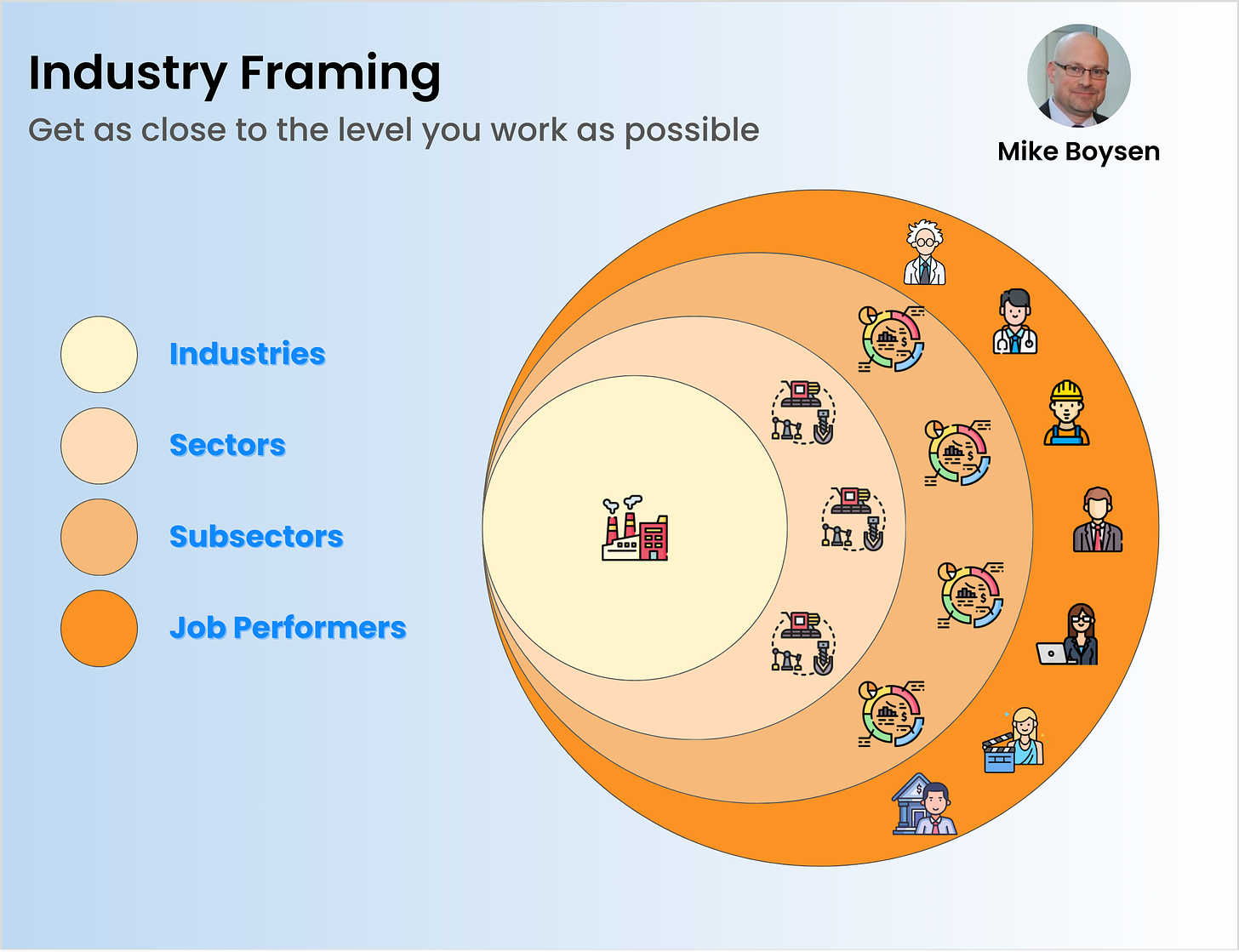

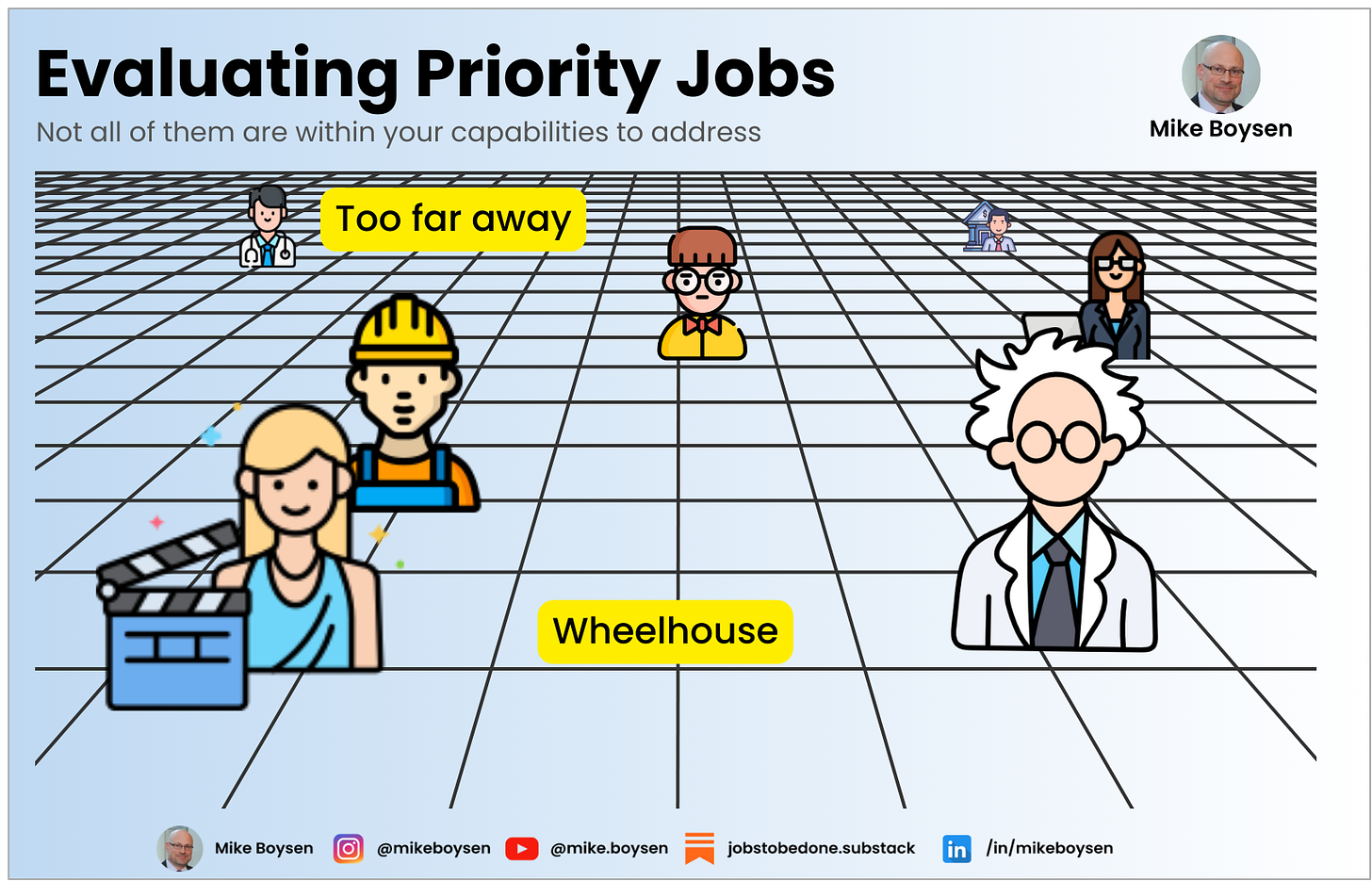

Perhaps the most resistance I’ll get from the progression above is about where it begins: Target Audience. Let’s say we consider the market to be all companies who are trying to achieve profitable growth. That’s all for-profit companies, which is too large to go after. We need to break that down into a needs-based segmentation first, and then understand why one group struggles differently than others when pursuing their objectives. It may have nothing to do with their industry/vertical.

Developing solutions, and related messaging, that target these groups separately is critical because they struggle to achieve profitable growth in different ways. They do this while operating in different modes, and in different circumstances within those modes.

Many marketing solutions today suggest that they can help you to select a target audience and then segment it. Yes, it is always helpful to break prospects down into smaller groups to facilitate testing and optimization of the return on marketing investment. However, I would suggest that those are micro-segments (or whatever word of the day you prefer). These are not natural needs-based segments within a naturally organized market.

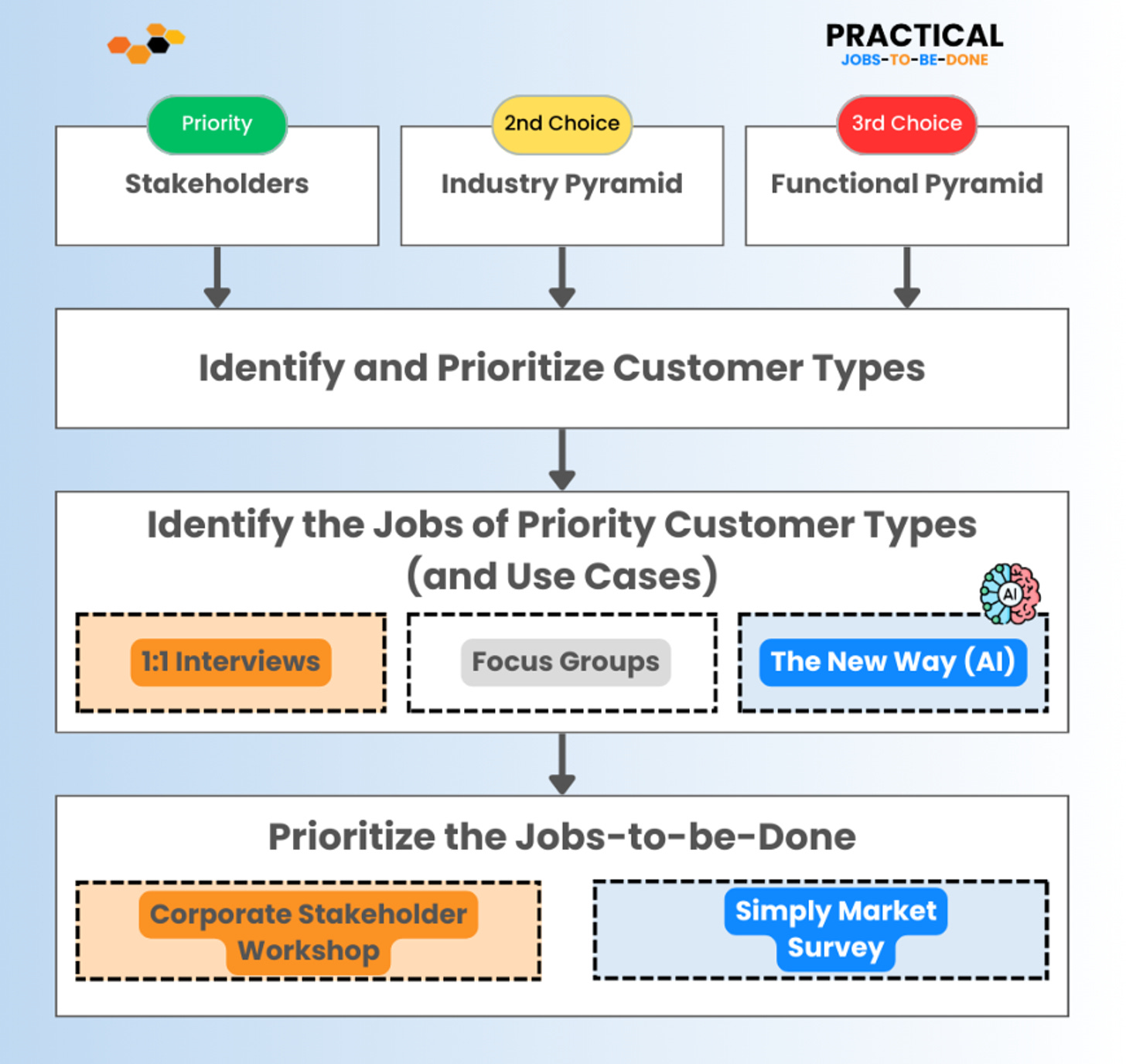

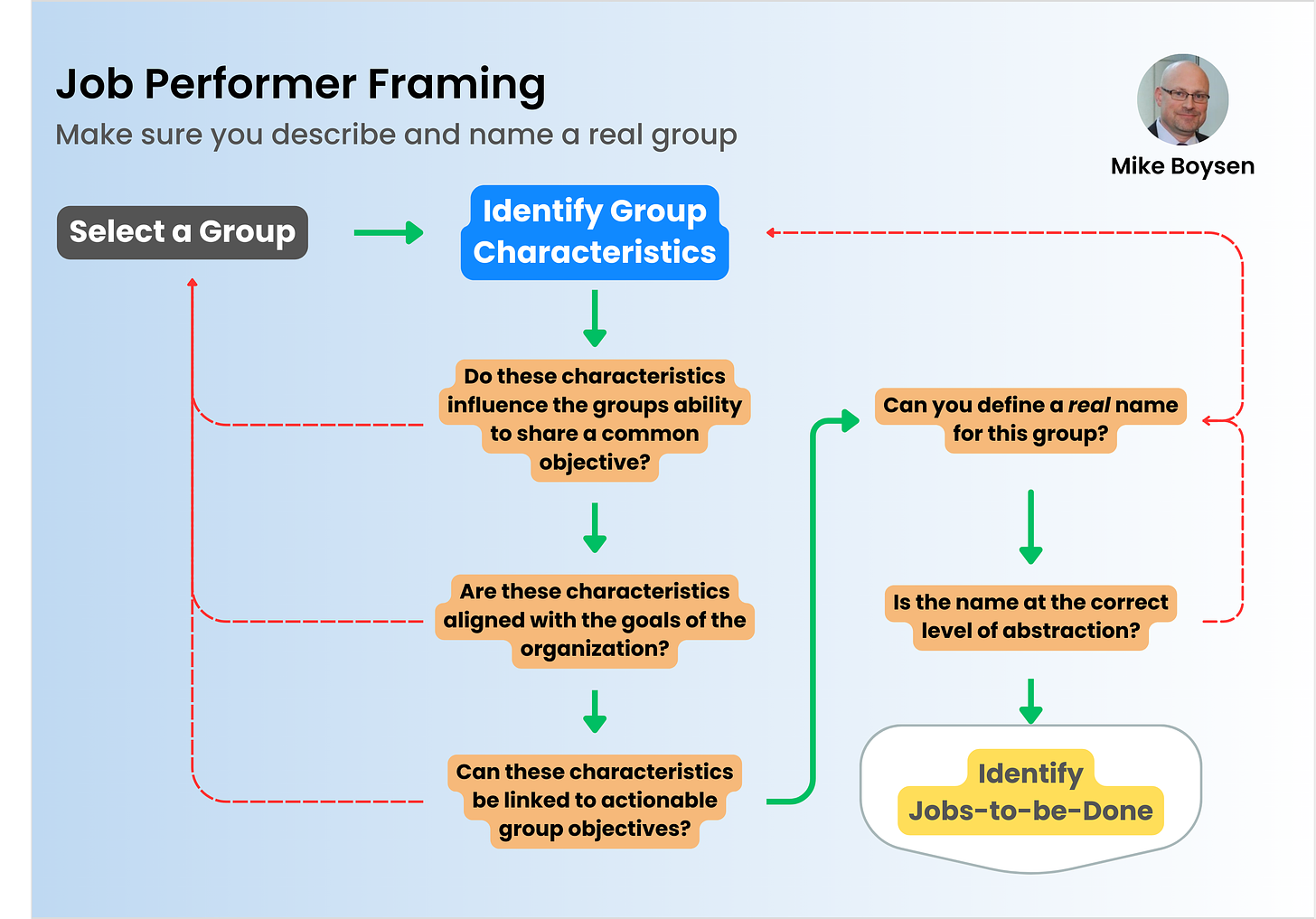

The process of identifying markets and their natural needs-based segments is a distinctly separate capability, and a prerequisite to both product development and marketing. Businesses who naturally segment objective-based markets before designing products have a far greater chance of success because they will have the requisite needs-based, prioritized inputs for solution conceptualization and design.

You can find an organic approach to segmenting objective-oriented markets here if you’re interested in more of the details.

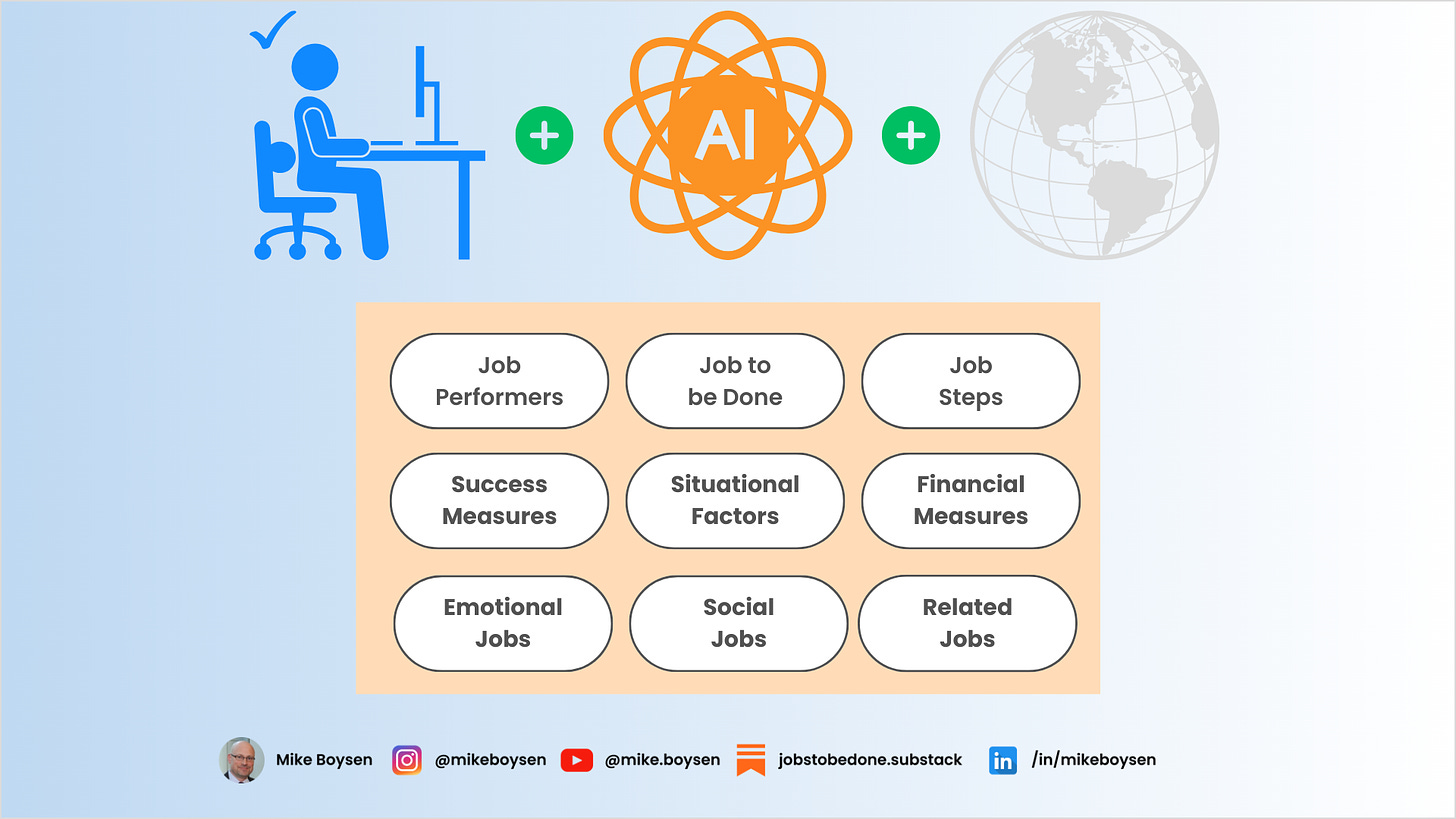

I won’t be using all of the following terms in this series but they will be used in subsequent writings, and also appear in the model(s) I hope to share later.

Market - a group of people with a common objective. This is the perfect target for creating solutions when viewed at an actionable level of abstraction

Segment - a sub-group within a market which have a common set of unmet, or over-met needs. This is the basis of a target audience

Marketer - a person (or team) that’s responsible for developing offerings around existing products and creating interest in those offerings which can be converted to revenue in future periods by quota-carrying salespeople, or systems.

Closer - A quota-carrying sales representative, or system who takes marketing qualified leads and converts them to revenue in the current period

Offering - the total offer to your customers, not just the product

Value Proposition - a company's statement that differentiates it from other offerings in the markets

Resources - information, tools, or human assistance integrated into various interactions and exchanged with prospects and leads in order to facilitate their purchase decision-making process

Channel - a communication pathway that a company offers its customers (a medium)

Touch Point - a location within a channel where interactions occur, e.g., landing page, a web form, etc. (a location within a channel)

Interaction - an occurrence between one or more parties at a touch point. Many interactions can occur at a touch point with numerous prospects / leads (an activity)