In this article you will learn:

What is a Jobs-to-be-Done (JTBD) product innovation strategy

Should you run a JTBD product innovation strategy?

What are the criteria for success for JTBD?

How to implement a JTBD strategy (step by step)

How to launch a JTBD pilot

In this article I’m going to share my recommendations on how to implement a JTBD function. It’s based on my experience working with the methodology for 15 years, experimentation, advisory, and discussions with my industry peers.

Why is Jobs-to-be-Done (JTBD) gaining popularity now?

Product strategy teams are looking for new innovation tactics since every single thing that’s been evangelized to them - while creating nice cottage industries - has failed to perform to their expectations. Product failure rates are as high as ever. While many are looking to Generative AI to save the day, it works with the same data they do - backward-looking. Accelerating and scaling data science misses a key consideration …

Customer Science

JTBD appears to be the best alternative (or complementary capability) to methods and practices that were designed for the solution-space. It’s a great way to focus on customers without falling into the trap of customer behaviors alone. With this approach, product leaders are less likely to burn their budgets by wasting time, effort, and dollars on approaches that have a success rate between 5-10% (and that’s a very generous range).

Imagine a world where our invested dollars weren’t wasted and we could apply what we lose today to more important problems for humanity!

What is NOT JTBD?

A lot of product leaders have been in this situation:

“We need to launch JTBD research! Let’s do it!”

They interview a handful of customers and ask them about a purchase decision, or…

They pick a canvas template that can run on a cloud-based whiteboard

They fill a room with internal stakeholders and sometimes customers

They generate ideas to fill in areas of the canvas

They admire their work

Their leadership asks “Now what?”

Then leadership says to the industry, “Yes, we’ve tried JTBD”

While in fact they’ve tried ‘standard ideation.’

Honestly, this is normal:

JTBD is still an obscure strategy

There are numerous erroneous and weak online resources. Unfortunately, they are the popular ones.

And it has recently begun getting popular among product leaders (and marketers)

That’s why I decided to create this complete (but simple) 5 part guide.

So what is Jobs-to-be-Done (JTBD)?

If I had to define JTBD I would start by describing the 5 pillars.

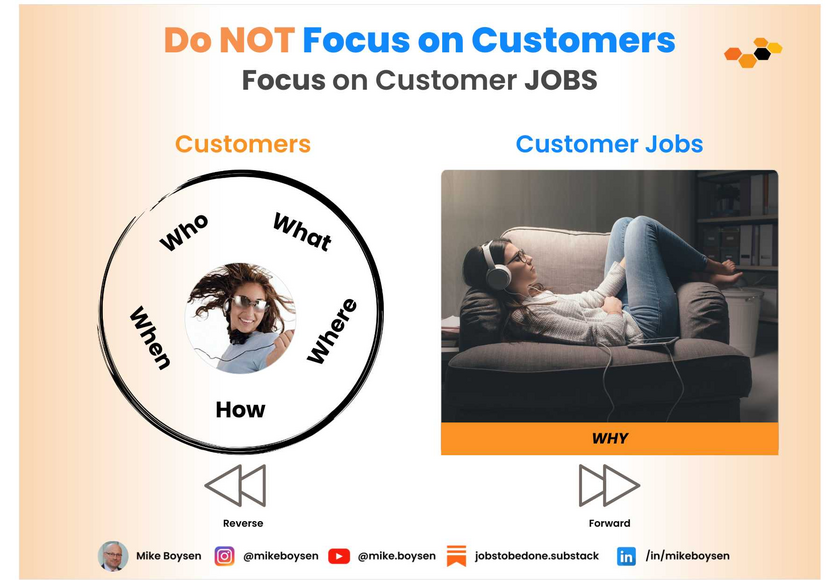

Choose and Prioritize Customer Jobs - not what they do, what they are trying to accomplish

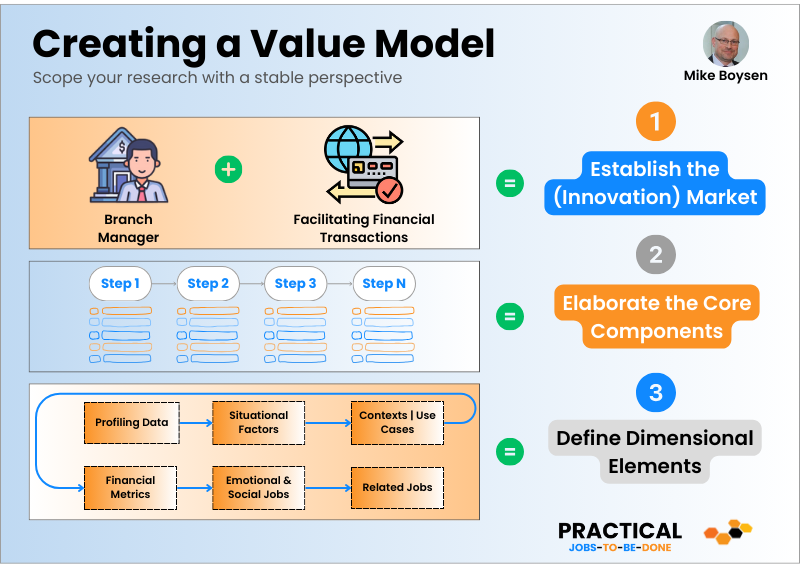

Develop value models for the priority jobs - these are stable depictions of the problem space which means you no longer have to field teams of super-excited employees to redo them twice a year.

Ask the market to prioritize your model(s) - and make sure you’re asking the side of the market that is actually spending the money. Yes, I know social media platforms get money from advertisers, but the advertisers are targeting people that spend money on products. So make sure you satisfy the product … er … the users.

Analyze the results and develop actionable insights - based on data, not guesses

Formulate a portfolio of strategic options based on the insights - you should be getting multiple possible strategies from this kind of research. You may not be able to implement all of them, but you should consider all of them.

With these 5 pillars you will understand the true nature of JTBD.

You should focus on developing strategic options that closely align with your internal capabilities to deliver. You have to take into account capabilities you have today, capabilities you could build or develop in the near-term, and capabilities you could acquire and leverage profitably. Just because you have uncovered insights does not mean they are actionable today.

It’s different than idea-first approaches to innovation which attempt to develop ‘valuable’ ideas and then test them - expensively or inexpensively - in the market with no way of knowing what the value is, or if there is value at all before having to invest ’s.

Should you run a JTBD product innovation strategy?

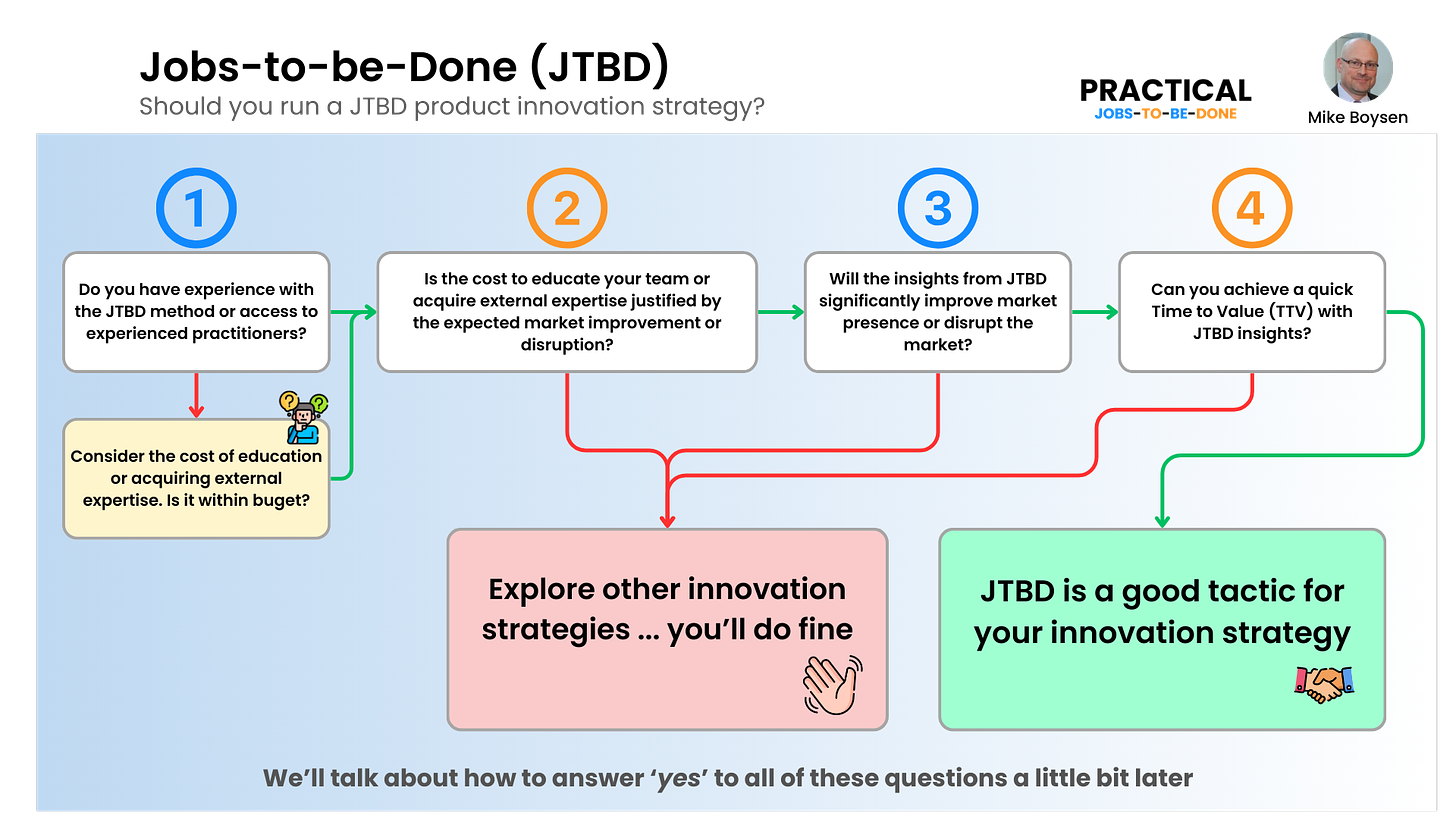

You might not realize this, but JTBD can be a long and manual process. Historically, these projects have taken 4 to 6 months and hundreds of thousands of dollars to complete (with consultants who know how to do it properly). So, the question you should ask is: is it worth it? Here’s what you need to analyze in order to make that decision:

Time invested compared to potential return on investment

Do you have experience with the JTBD method or access to experienced practitioners?

Yes → Proceed to question 2

No → Consider the cost of education or acquiring external expertise. Is it within budget?

Yes → Proceed to question 2

No → JTBD may not be feasible at this time

Is the cost to educate your team or acquire external expertise justified by the expected market improvement or disruption?

Yes → Proceed to question 3

No → Explore other innovation strategies

Will the insights from JTBD lead to a product or service that significantly improves your market presence or disrupts the market?

Yes → Proceed to question 4

No → JTBD may not align with your innovation goals

Can you achieve a quick Time to Value (TTV) with JTBD insights?

Yes → JTBD is a good tactic for your innovation strategy

No → Consider if the longer TTV aligns with your strategic timelines

Is there a more cost-effective method that aligns with your innovation goals and provides a quicker TTV?

Yes → JTBD might be a secondary priority

No → Implement JTBD as it aligns with your strategic goals and resources

📌 Note: You should measure the cost of initial attempts to hire or learn about JTBD strategy and take that into consideration. However, you should also ask yourself what the outcome could look like spread across all future innovation research investments. If you invest to learn it, and do it right the first time it will be a game-changer for your business and everyone else will be wondering what you know that they don’t know.

By now, you should know if JTBD is the right approach for your innovation strategy. The next step is to understand exactly: How to implement a JTBD strategy (step by step)?

The JTBD Process: from ‘executive demands’ to market disruption

In this section I’m going to break down my simple step-by-step process for thinking through the implementation of JTBD for innovation work. Here are the 8 steps.

Identify the group of people (job performers) that are the focus of your research

Identify a set of a jobs that this group of people performs

Prioritize the jobs based on company objectives or market prioritization

Construct one or more value models from quantitative research

Prioritize the model(s) in the market with people who perform, or have recently performed the job

Analyze the results and develop a portfolio of strategic options

Prioritize the options and perform fast, easy, and cheap experiments

Begin the implementation of your final option(s)

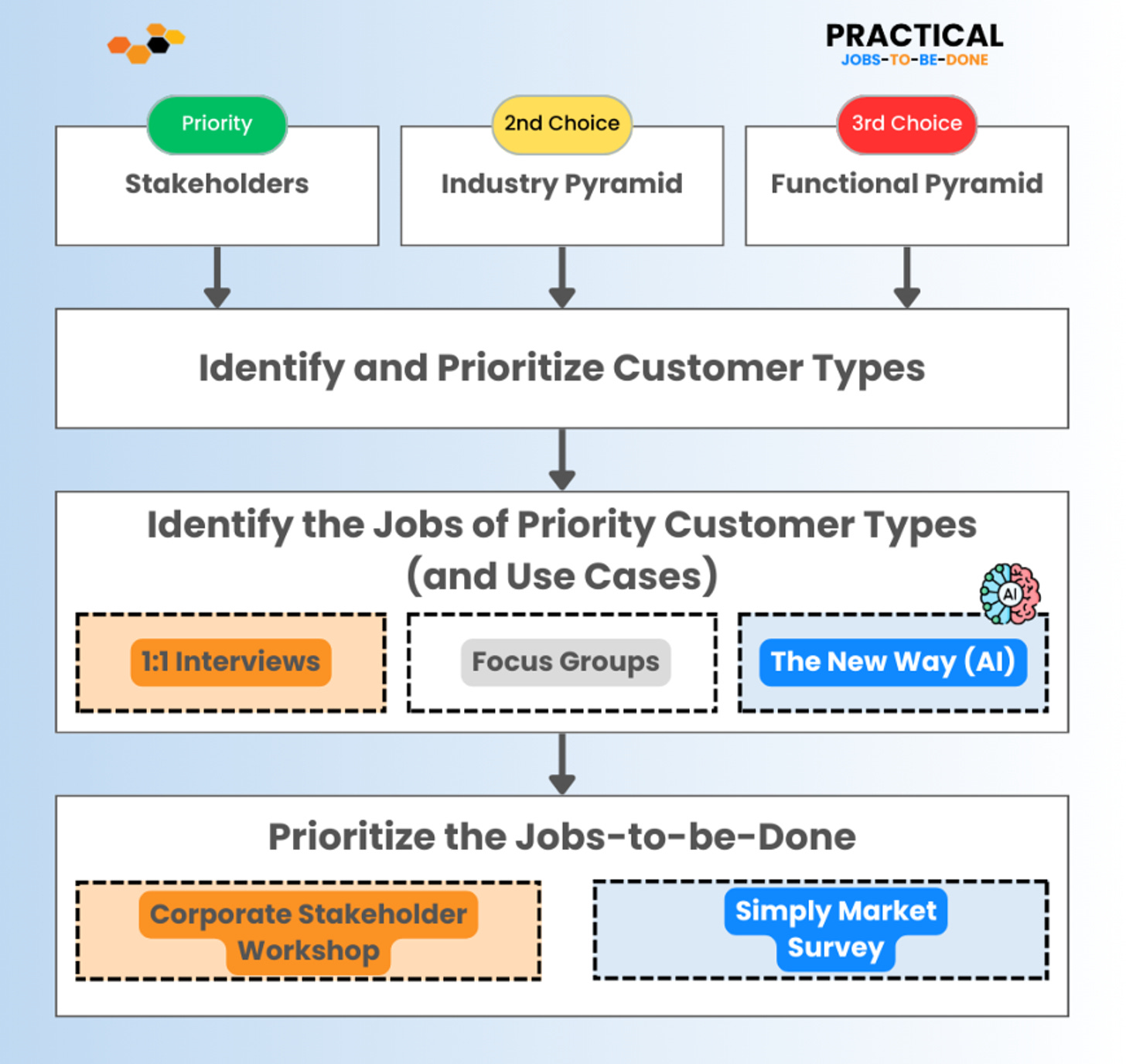

1a. Identify a group of people your stakeholders are most interested in (Priority)

When you are working for others - which most of us are - their interests should be your top priority. They have reasons for wanting to focus on specific customer groups and use cases that you may not be aware of. But you should definitely become aware of them!

The objective of this step to begin the framing of an innovation market. This is very different than what marketers do. We cannot afford to make up personas that do not exist in the real world. We must define a real group of people who are trying to get the same job done.

In most cases, you are not starting from scratch. After all, you’re involved in a business and probably already have products and/or services. If not, we’ll address that in the other options.

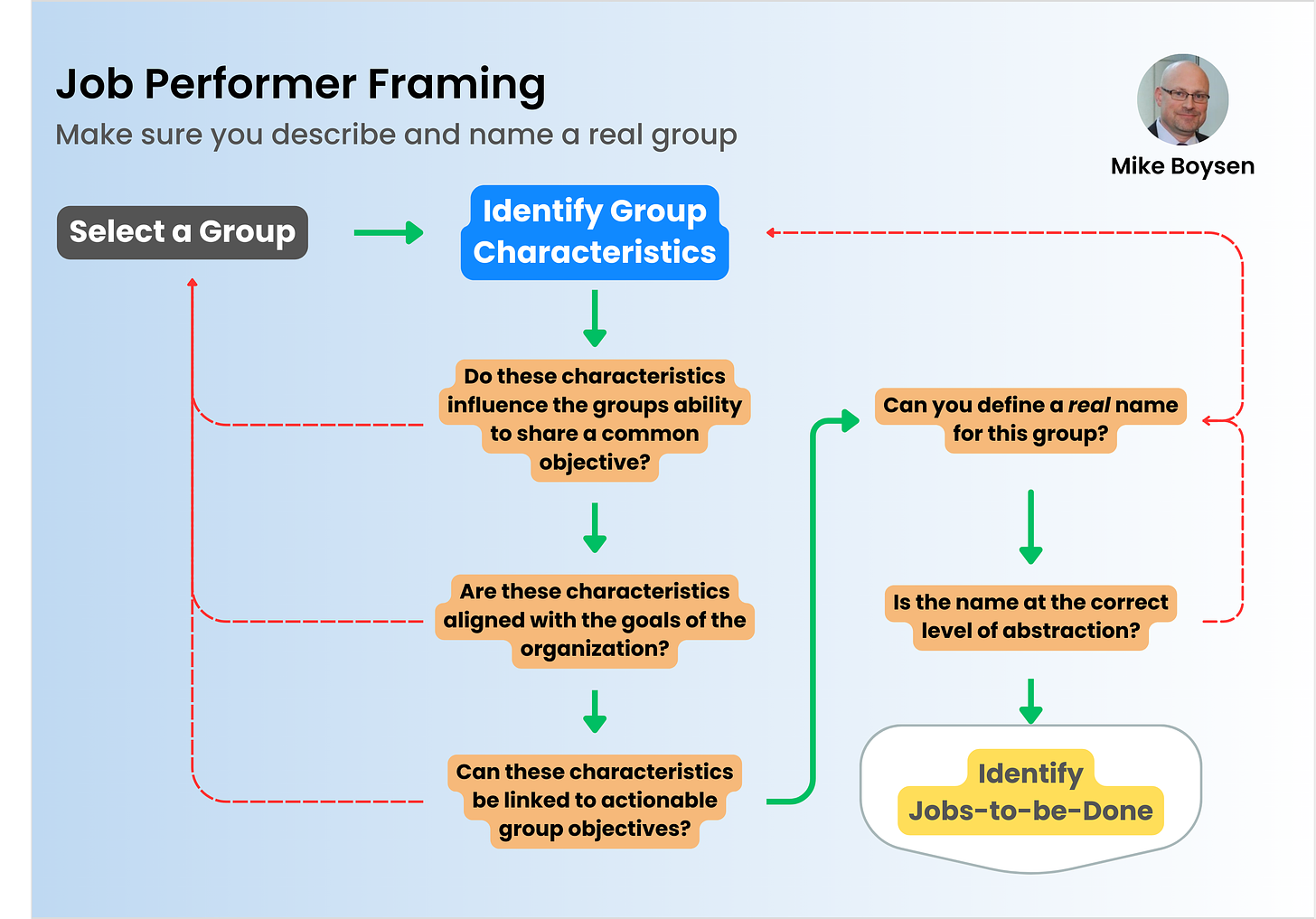

Here’s a simple (very simple) decision framework you can use:

Create a simple decision framework to collaborate with your stakeholders

Given your organization’s existing portfolio, or capabilities, elicit a description a group or groups on which your stakeholders want you to focus

Confirm that the characteristics you elicit are aligned with the goals or capabilities (you can take action on) of your organization

Give the group a common name. If you can’t do that, you need to revisit the characteristics

Do you want a more specific group, or a less specific group?

[Pipefitter] or [Electrician]?

[Electrician] or [Carpenter]?

[Electrician, Carpenter, Pipefitter] or Tradesmen? ←—- perhaps they all have some jobs in common

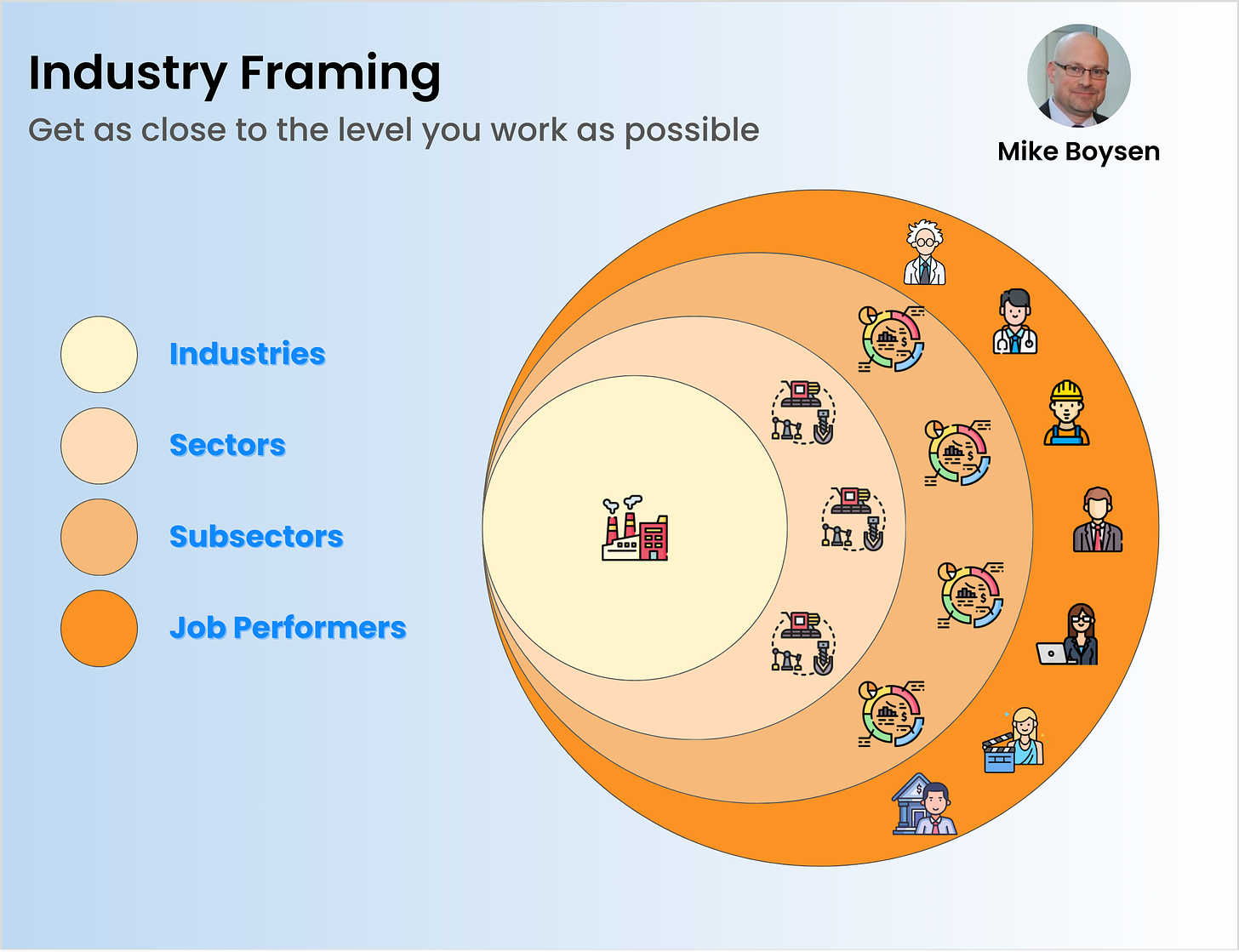

1b. Find Job Performers Based on an Industry and Sectors that You’ve Cataloged

If you are given the latitude to craft your own research, you may want to do so within the industry that is paying your salary. What I’ve found is that jobs at the industry level are too vague and/or high level. I’ve often had to drill down 3 or 4 levels before I found something worth pursuing.

I know what your thinking: “How does he do that?”

Well…

I cheat!

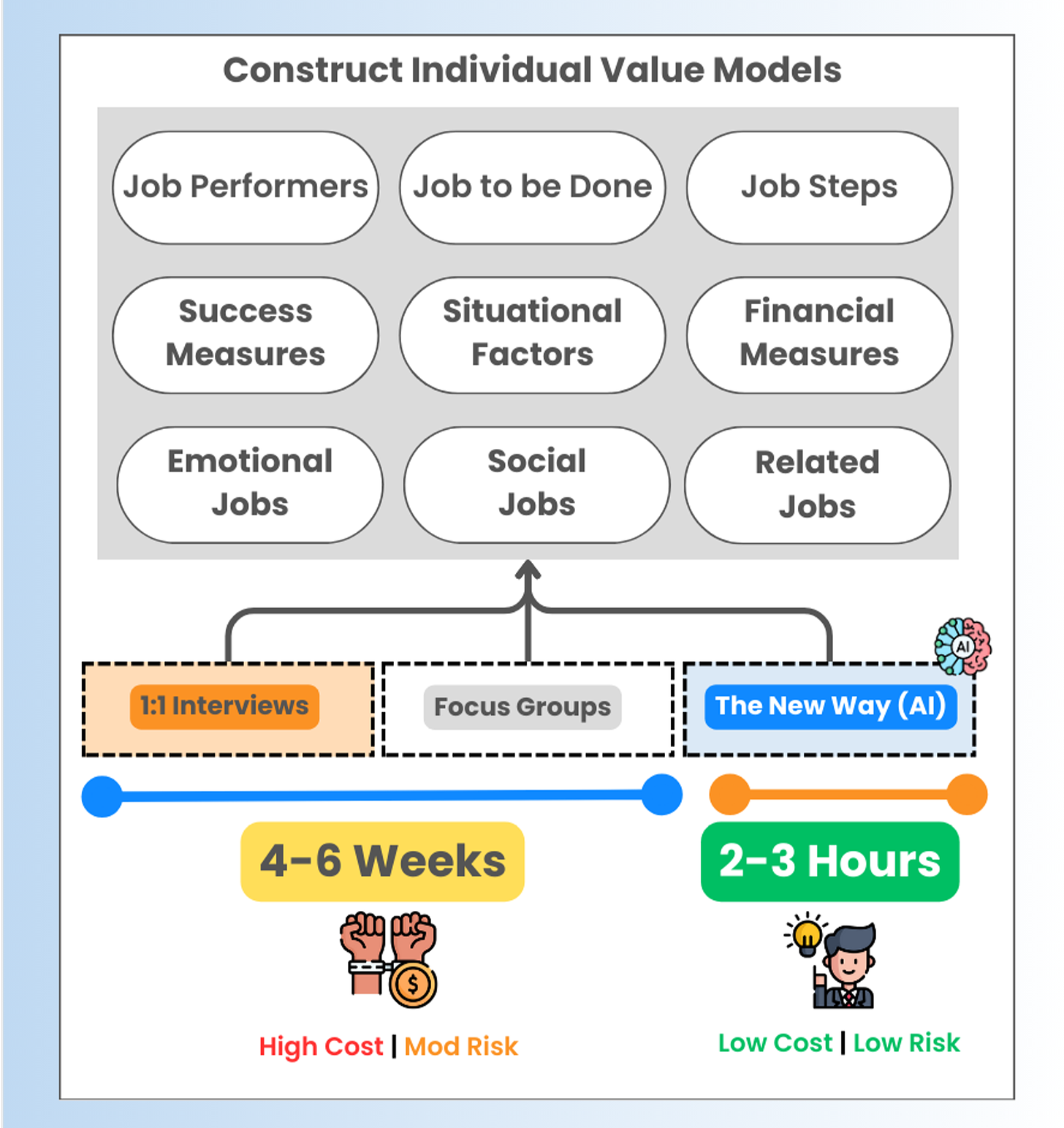

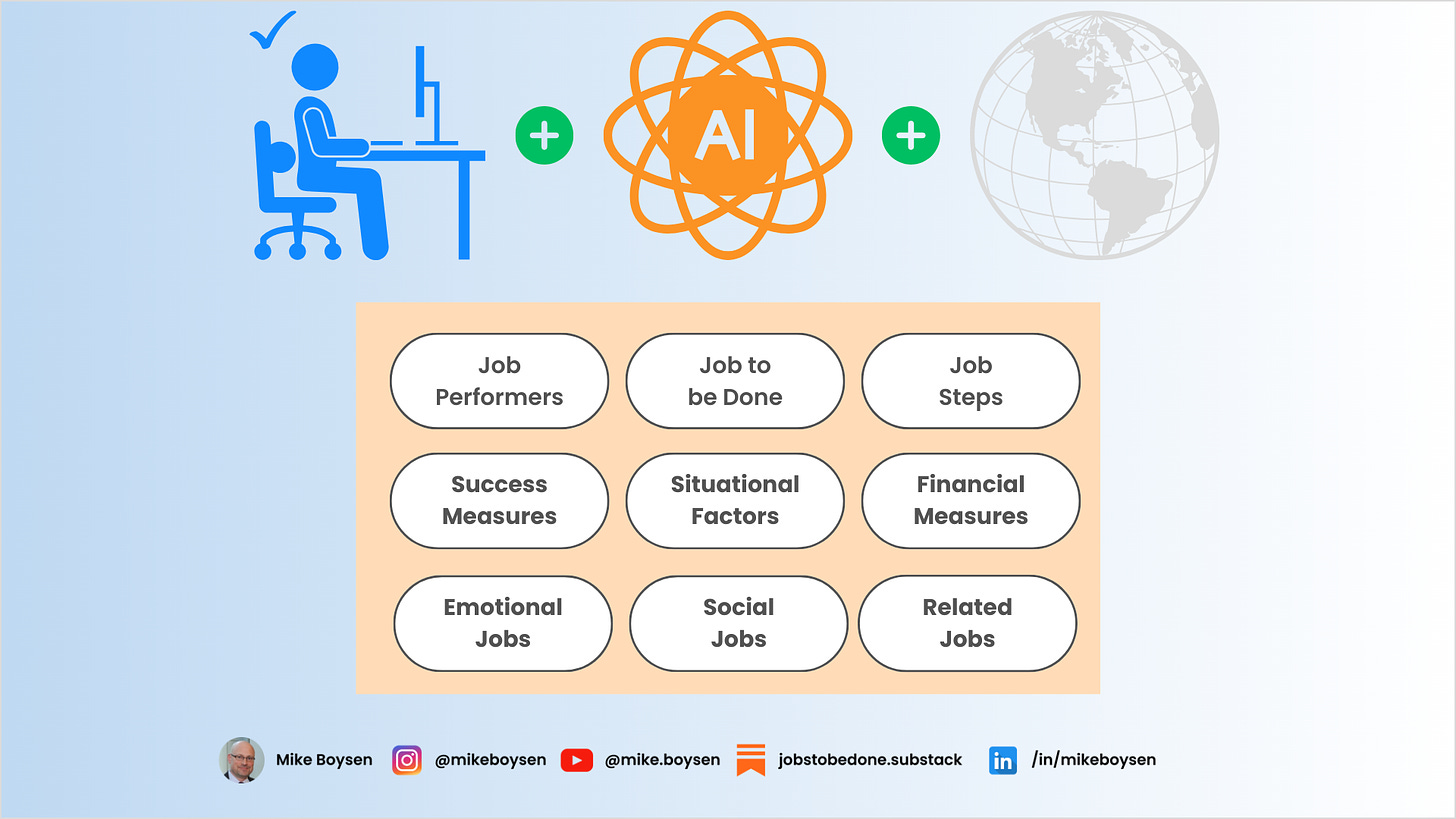

Many of you know that I developed an AI-based architecture for qualitative research. When I suggested above that it takes 2-3 hours vs. 4-6 weeks I was not kidding!

📚 If you want to do it the old way, I’ve offered a lot of help in the past. Here are two options for you:

How To Get Results From Jobs-to-be-Done Interviews | by Mike Boysen | JTBD + Outcome-Driven Innovation - the polished guide to real Jobs-to-be-Done interviews

A Framework of JTBD Questions - This is the original (now in Notion) which helped a lot of people - if all of those anonymous google doc avatars mean anything. It even has the original JTBD canvas at the end.

For this particular exercise you can use the following prompts, which were designed and trained specifically on ChatGPT 4 (or OpenAI). This is a Notion document…

You can duplicate this Notion template if you have an account. Otherwise feel free to copy and paste them into your favorite note-taking or database app.

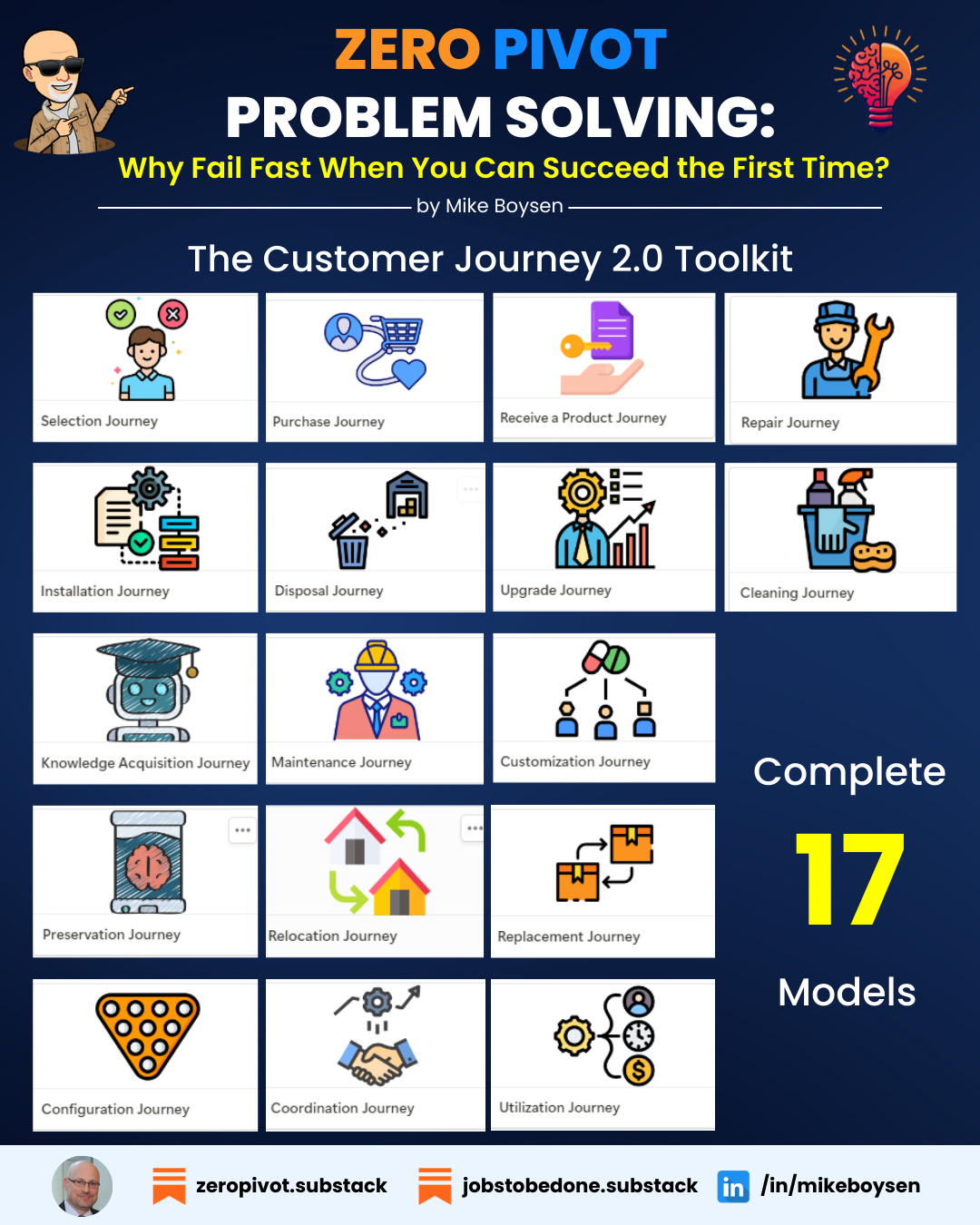

1c. Find Job Performers Based on a Functional Breakdown of Jobs You’ve Already Cataloged

This is an approach that can be useful for those of you who have already built a value model If you think of jobs as a pyramid with your value model in the middle somewhere, going lower in the pyramid means treating each step as a job.

Or, if you’ve identified contexts for the job (I cover that in my Masterclass) you can also break your job down into more focused contextual jobs (and maps). That will make your pyramid multi-dimensional but the world is like that, so be prepared to deal with it. 😂

Going higher means considering your current job as an step (it could be in any of the 9 phases) in a higher context job. Some ways to look for that:

Review Related Jobs - These are adjacent jobs that you should be capturing during the development of any value model. They occur before, during, and after your current job. These are good candidates for adjacent steps in a higher context job

Narrower (lower) - You can use this prompt to tighten the scope based on your current job model. This is useful when you’re trying to improve customer experience.

Broader (higher) - You can use this prompt to loosen the scope based on your current job model. This is useful when you’re looking for significant growth opportunities.

Learning JTBD is still important, but how long will this really be necessary? 😉

2. Identify the Jobs for this Group of Job Performers

Doing it the Old Way

Traditionally, we’ve done one-on-one interviews (or focus groups) with job performers (whether they used a solution, cobbled multiple solutions together, or did it themselves). These are laborious, time-consuming, and can be expensive if you are interviewing highly trained professionals. Here are some additional concerns with this process:

People trained in qualitative research struggle - they’ve been trained with a completely different end in mind, therefore they ask the wrong questions, listen to the wrong things, and they tend to interpret most things they hear as paint points. We’re not looking for pain points.

People with a lot of experience have elevated bias - they get too comfortable with what they know. Since this is an innovation exercise that has a much higher impact of failure than a marketing experiment, it’s what you know that isn’t so that becomes problematic. But, try convincing anyone of that.

Every human comes with different baggage - we all have different experiences and perspectives, and these hinder our ability to think and act objectively. Give two experienced practitioners the same challenge and a different set of subjects, and you will get completely different results, guaranteed!

I linked to the definitive guides on how to conduct these interviews earlier. There is nothing else like them on the Internet.

Doing it the New Way

Imagine having access to an unlimited number of subjects - all having deep experience and knowledge in the space you are researching. Compare that to 8-10 subjects that are randomly selected, have limited experience and expertise (regardless of screening), and are being asked to validate your strawman more so than being asked to build the model through the interview.

Yes, this is a problem!

I know! You, and your colleagues, are the one exception to this. But, I clearly haven’t met you or seen your work. Call me! 📞

While I do have biases myself, I am also a student of the rules of jobs to be done. At least, I studied under an extremely rigorous method and helped to refactor all of the training content. So, they got burned into my brain.

While I do break rules - I like to call them experiments - I have designed rules into my AI prompts so that I can expect to get pretty consistent results (when using a single Large Language Model). It took over a year of designing and testing, and I have made many changes since I published them (sorry), and they do more than a good enough job to replace those biased humans. They could disprove Clay Christensen’s theory of disruption … they’re that good.

After all, we have more important things to do than just interview people. If that’s what you do, my sincere apologies.

If you’d like to spend a month doing interviews, have at it. I can do that work, organize it, and be ready to field a survey in a day or two. And I’m talking complex Jobs-to-be-Done surveys - not customer satisfaction surveys.

What? You don’t have a year to design and test AI prompts to identify the jobs of a group of people - and don’t know any of the rules?

Here, I’ll give you a hand. This AI Prompt is very general but will set you on the right path. It will generate a list of jobs and describe the for a Job Performer you provide. You can control how many jobs you’d like it to identify for you.

3. Prioritize the jobs based on company objectives or market prioritization

You can tackle this one in a number of ways. Since your work-shoppers are going to be looking for things to do soon, you could use their skills to put together a structured decision-making workshop whose underlying theme is to eliminate as much noise and bias as possible. While many professionals have an approach to eliminate bias it’s likely that very few of them have an approach for eliminating noise. Even fewer have put the two together.

Description of workshop - use an approach like the Mediating Assessment Protocol (MAP) as a quick and structured approach to evaluating and prioritizing the customer jobs in the market. The two factors to consider are how customers would prioritize these jobs in their lives (in the minds of the participants - who are not customers) and the capabilities of the organization to deliver solutions on high-priority jobs.

Visualization of a market scan survey - Field a relatively simple survey to ask real job performers a number of basic questions about the list of Jobs you’ve developed. No need for job mapping since we’re just trying to determine whether there is a reasonable opportunity to add value. Rate things like Importance, Difficulty, Frequency, Spend, etc.

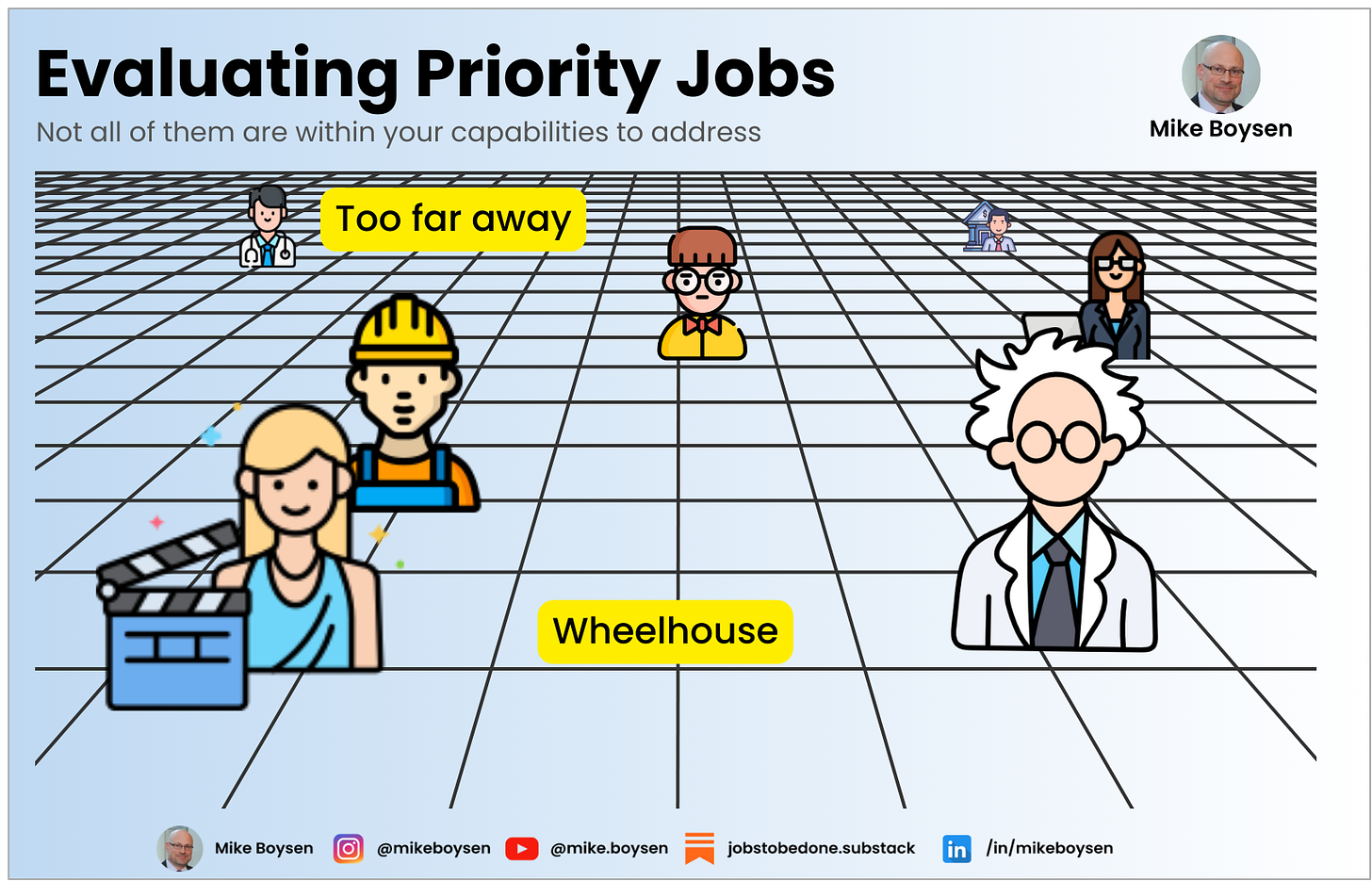

Not all priority jobs are within your reach to deliver new value:

From the top jobs, which are closest to your current capabilities?

Which require capabilities that you can develop or acquire in the near term?

Which are well outside your capabilities for the foreseeable future?

4. Construct one or more value models for quantitative research

You may opt to do this the hard way, or the easy way.

Regardless of your approach, Jobs-to-be-Done is not about interviewing customers for their pain points. This approach always results in a recital of Job Stories that conflate functional, aspirational, experiential, and emotional concepts together. This may sound great to executives who like to hear stories after one week of research. But, the evidence shows an increasing lack of trust - due to a lack of results - in this cottage industry approach to Jobs Theory.

Results: As with a training curriculum, it’s a bad input to ask students what they thought of your course at the end: “I just loved how I could fill out the wheel, it was beautiful!”).

It’s a much better input to ask their boss how the training impacted the results of their work a few months later: “We increased market share by 20% in 3 months and now I trust JTBD!”. 😉

I realize I won’t convince everyone. As Samuel Clemens said “It’s easier to fool someone than it is to convince them that they’ve been fooled.”

There is no shortcut to actionable insights.

However, the laborious path to actionable insights can be obfuscated without producing an inferior results. This is the next digital transformation!

I hesitate to even point you to the work I’m doing because every single day something new emerges that makes me re-think not only my approach, but what the outcome is. “I picked a helluva year to quit drinking!” 🎥✈️

5. Prioritize the model(s) in the market with people who perform, or have recently performed the job

One of the reasons we see so much love for workshops is because relatively speaking they are quick, easy and cheap.

And, you get what you pay for.

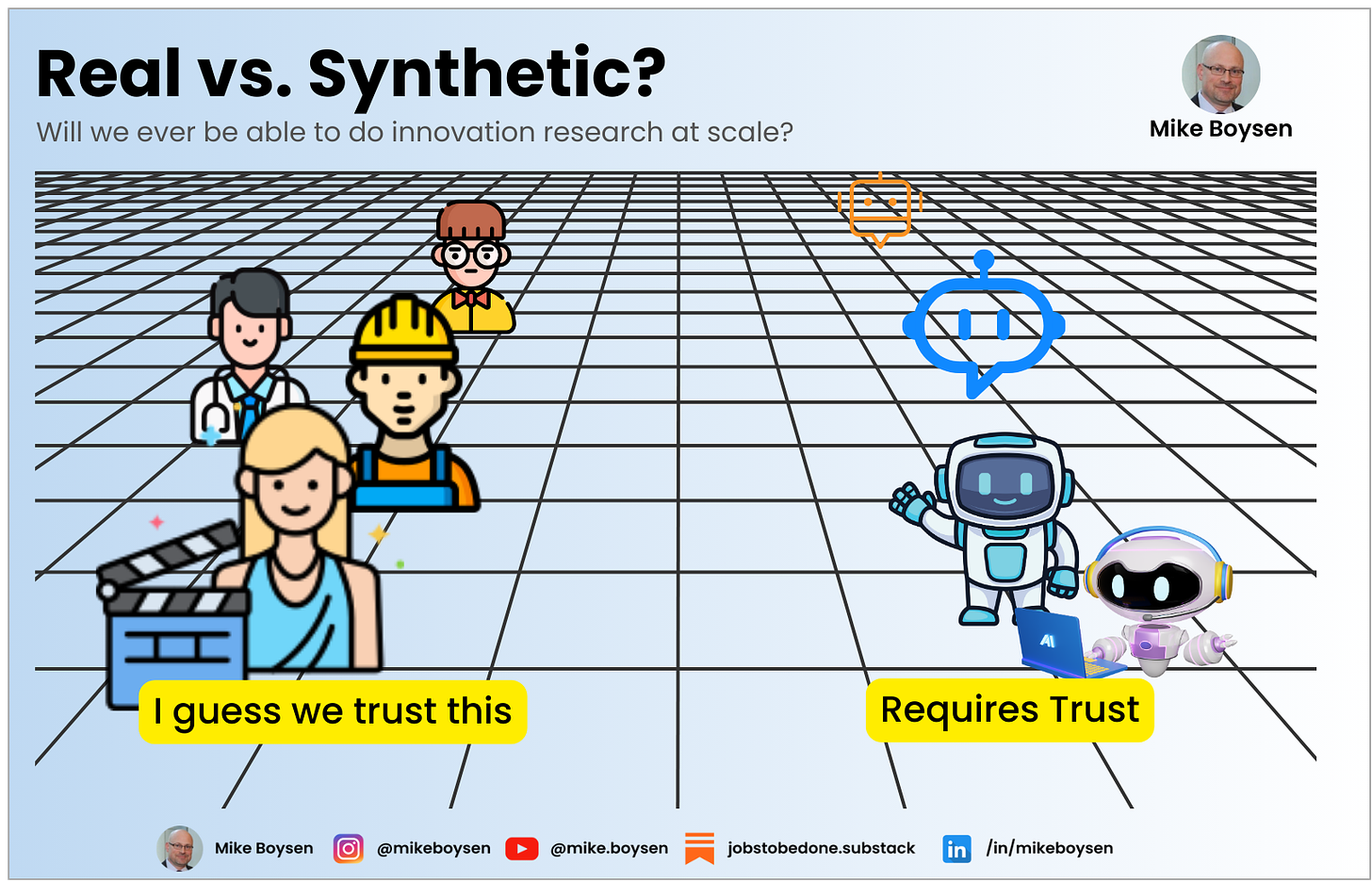

So there are two ways to prioritize customer success (or struggles, depending on how you look at it) and one new way that is being studied by academics

Internal Workshops - Once again, if you’re going to do them, at least put some effort into reducing bias and noise by using a structured decision-making approach like MAP. While this will not reflect the actual market from an unmet needs perspective (although you should include it) it does facilitate an ability to deliver perspective. Approaches like this help you get closer to the correct decision. You could also develop a capability model approach.

Appropriate Survey Instrument - I say appropriate because many will default to letting their inexperience drive this, or worse, allow the marketing department to design it! I’ve already addressed my opinion on this several times, but here’s a link to one of those rants. I’ve been working on a streamlined approach with some friends to craft and field these at scale while also considering the structure of the output for lightning fast data model construction for analysis. It’s pretty cool!

Synthetic Respondents - I’m amenable to considering this because I’ve had so much success using them to develop entire value models in minutes instead of weeks. However, there is a difference here. In a prioritization survey, we’re actually asking for an opinion, or perspective on a set of measures of success. How to ensure that we provide every possible combination of situational factors and contexts is paramount. While academic research is happening and showing an unbelievable amount of success, the research may not align to what we’re doing here. So, as better tools emerge I will be doing a lot of testing against benchmark research

The benchmark has to be consistent - e.g., generate models that are devoid of bias from humans

The proximity will need to be established - what is the best way to determine how close synthetic respondents are to real respondents and what level will be considered adequate (that will likely vary by market segment).

6,7,8 Coordinating between problem-space research and solution-space work

We’re moving further and further away from JTBD research and into areas that are closer to implementation. Many of you are probably masters at this, and this is a completely different competency I do not wish to short-change in a simple guide.

Here are my high-level thoughts on what needs to happen.

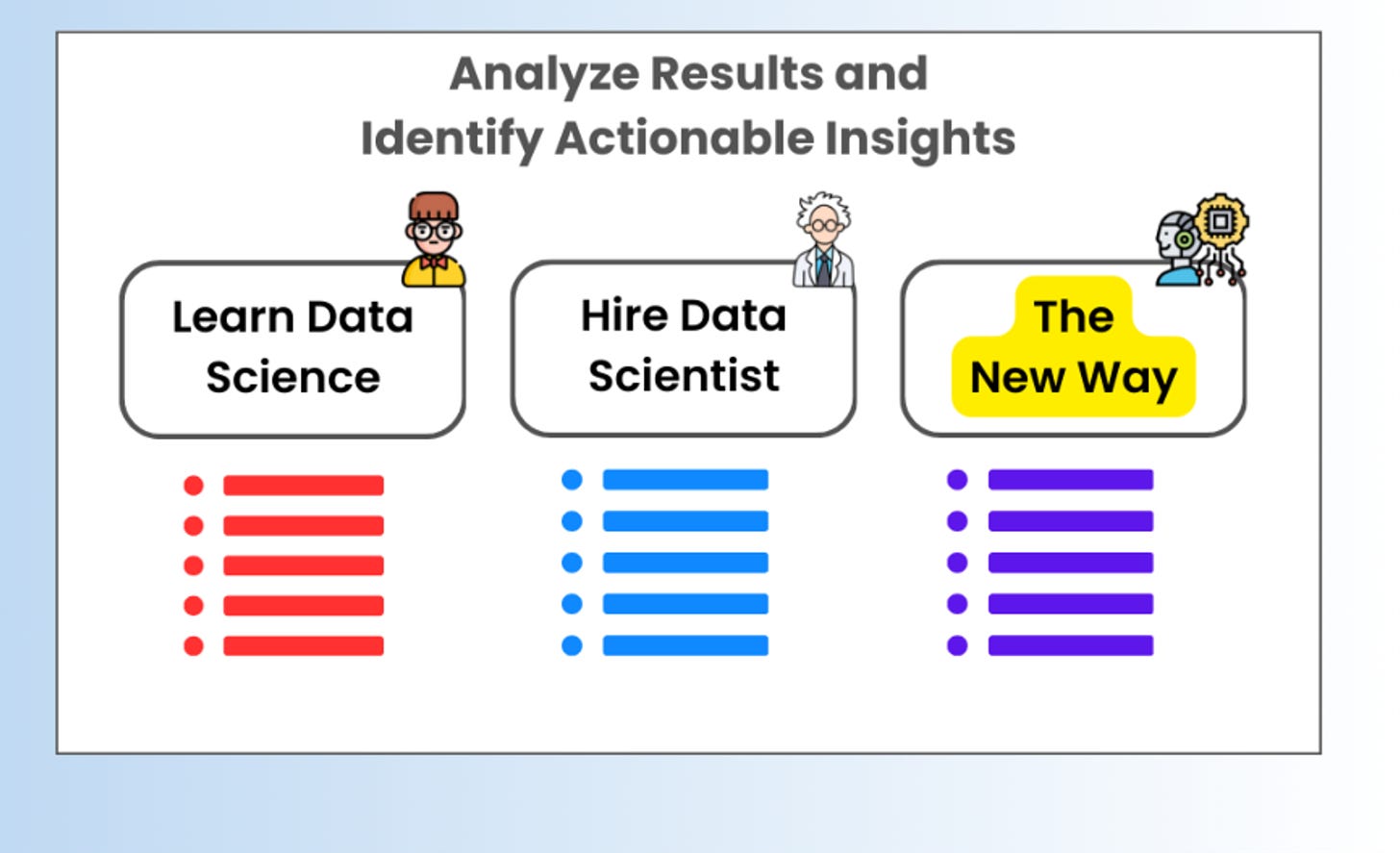

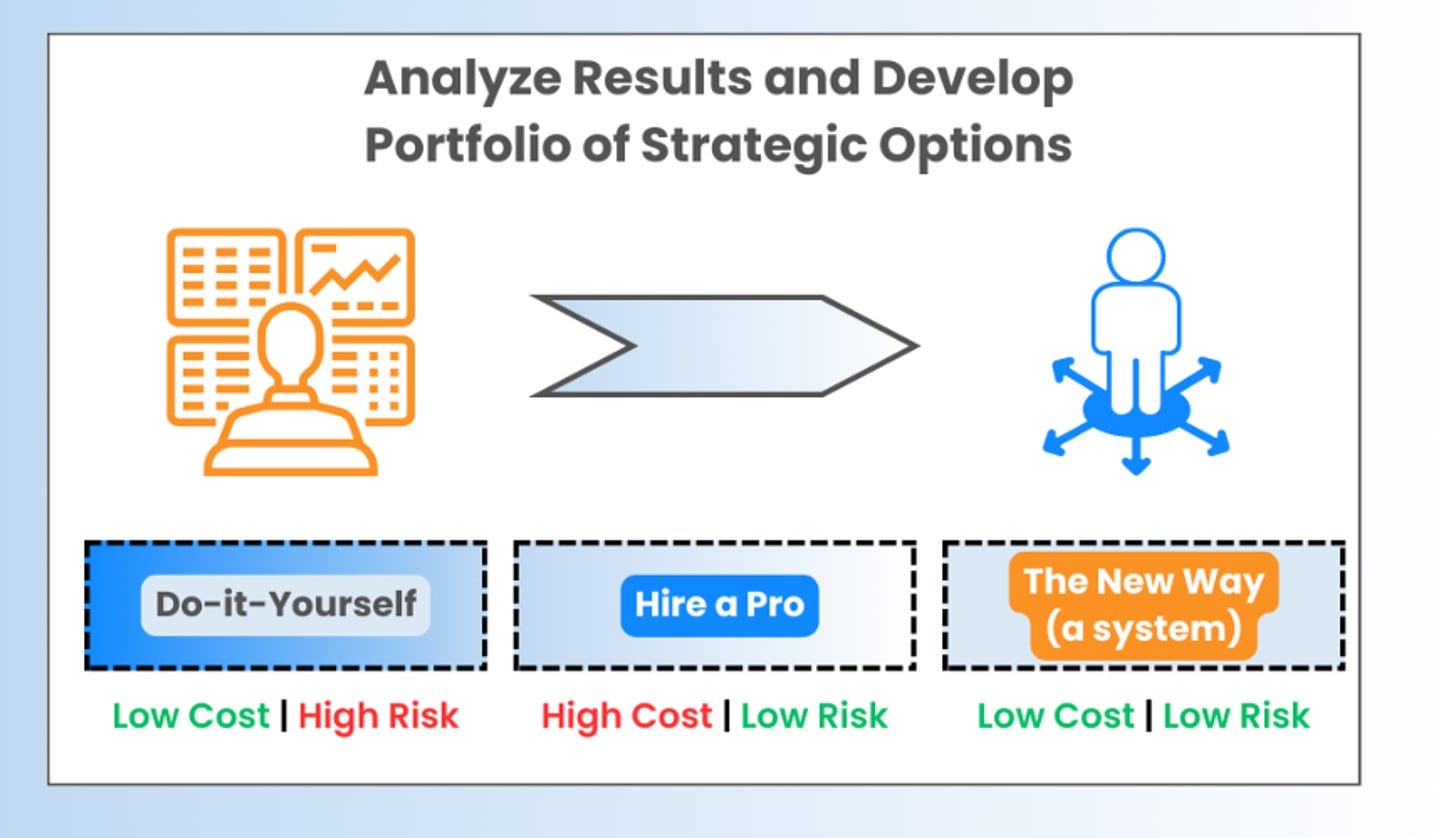

Analyze the results and develop a portfolio of strategic options

You will generate an overwhelming set of data points - so make sure you address your research questions back in step 0

Identify the insights that will answer your primary questions - theme them, if necessary, into groups

Identify potential root causes for the theme (or insights) and actions to close the gap - these are useful inputs into concept design, experimentation, and strategic road-mapping

Do not believe there is only one strategy - kick that person out of the room!

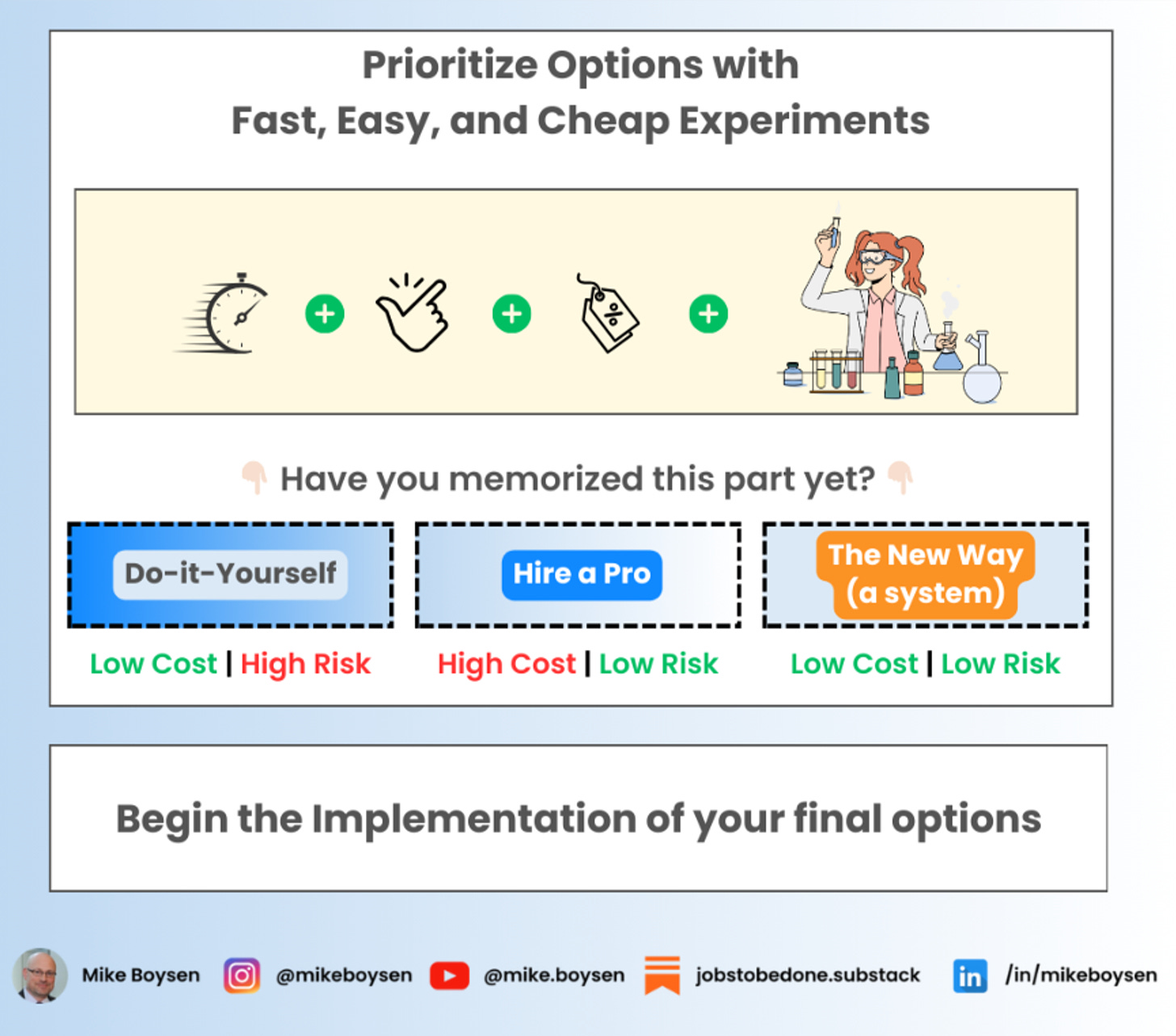

Prioritize the options and perform fast, easy, and cheap experiments

Consider all of your options - you won’t be able to take action on everything - at least not in the near term - since every organization is constrained on a resource level. But, you should consider all of your options.

Prioritize your options - this will be more than just customer prioritization, you need to consider your capabilities

Conceptualize solutions for priority options - let your design team use the inputs you provide to see what they come up with

Determine the best option / concept through experimentation - there may be more than one that you can implement in the near term. Design fast, easy, and cheap experiments to test the concepts you’ve developed.

Begin the implementation of your final option(s)

I don’t know anything about your business, so I must end this here!

All the Best!

Mike