This is the first post in a series of posts about constructing Jobs-to-be-Done surveys. I’m sure many of you have done plenty of surveys. However, based on the reactions I’ve seen from seasoned veterans when these are put in front of them, they are aghast at the length and complexity.

Hey, you do what it takes to get the best information you can get, and the traditional ways are only good if they validate your bosses opinion. That’s not the goal here.

Analysis Plan

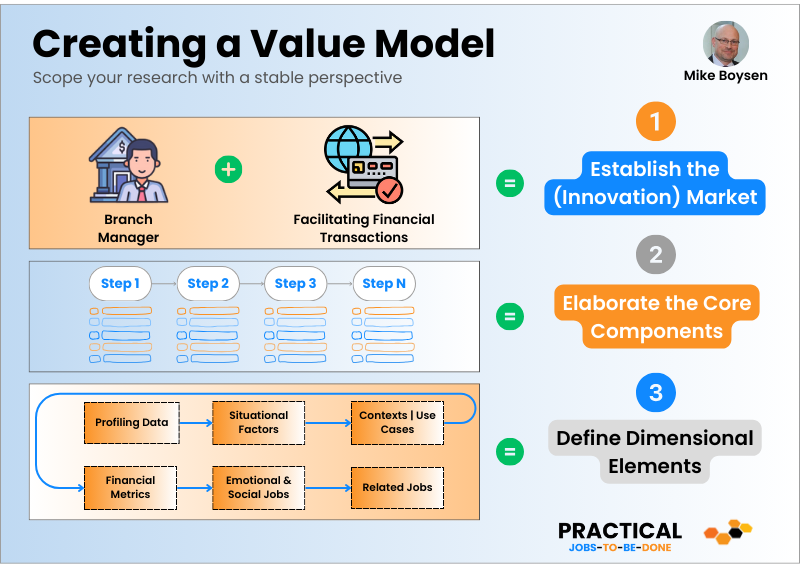

Having an analysis plan in place before initiating research serves as a structured blueprint that guides the data collection, evaluation, and interpretation processes. It ensures that the research team aligns on key objectives, methodologies, and expected outcomes, thereby enhancing the rigor and focus of the investigation. An analysis plan minimizes the risk of going off course, prevents wasted resources on irrelevant data, and ensures that the research effectively addresses specific questions or challenges. This pre-planning stage makes the subsequent stages more efficient and ensures that the research outcomes are both actionable and relevant, thereby maximizing the impact of the study.

The following is a basic breakdown for a study that focuses on consumers who have switched wireless telco providers recently. While I’ve done this study, this is not the analysis plan that was used. This essentially helps you define the approach to your research by keeping the end in mind. So, make sure you get all of the questions your stakeholders want answers to so you can make sure you have the data you need to answer them.

I recommend a workshop exercise called Question Storming. If you can’t find that on Google, ChatGPT will outline the entire process for you 😏

The following is a basic outline for an analysis plan…

Project Goals

Your goals might be different. This is just an example. But, each goal you have should be broken down into a set of bullets that provide more detail. Also, this needs to be socialized with your stakeholders to make sure they understand what they’re paying for, and that you have their agreement on the direction and outcomes of the study.

Understand Reasons for Switching Providers

Identify Customer Pain Points in the Switching Process

Examine Customer Satisfaction with New Plans and Phones

Analyze Competitive Differentiators

Understand Reasons for Switching Providers

Conduct a qualitative analysis of consumer interviews to identify the steps they must accomplish when switching, and the customer success metrics they use to evaluate the process

Perform a quantitative analysis of survey data to prioritize the qualitative model

Use data mining techniques to identify patterns or trends among those who have recently switched

Identify Value Gaps in the Switching Process

Leverage the prioritized Jobs-to-be-Done metrics to quantify the importance and satisfaction of various "jobs" in influencing customer decision-journeys.

Understand the emotional and social aspects of the switching process to influence differentiated messaging

Understand other (related) jobs a consumer is trying to accomplish before, during and after switching, to finds ways to get help them get more jobs done at the center of a switching decision

Examine Customer Satisfaction with New Plans and Phones

Determine what the key drivers are around plan satisfaction and dissatisfaction

Determine what the key drivers are around device satisfaction and dissatisfaction

Determine what the influencing factors are that drive consumers to leave a brand, what pulls them into a new brand, what keeps them in the funnel until the switch is complete

Determine how consumers learn about brands, plans and devices and which they trust most

Analyze Competitive Differentiators

The beautiful thing about real Jobs-to-be-Done is that it establishes common performance benchmarks for competitors. This makes the concept of brand-developed feature matrices laughable. There is no hiding behind that first column of green checkmarks any more.

Determine well the top brands compete using a common set of core success metrics

Determine important decision factors that no brand is talking about

Identify important areas that need improvement, improve them, and then message to them

etc.

Analyses

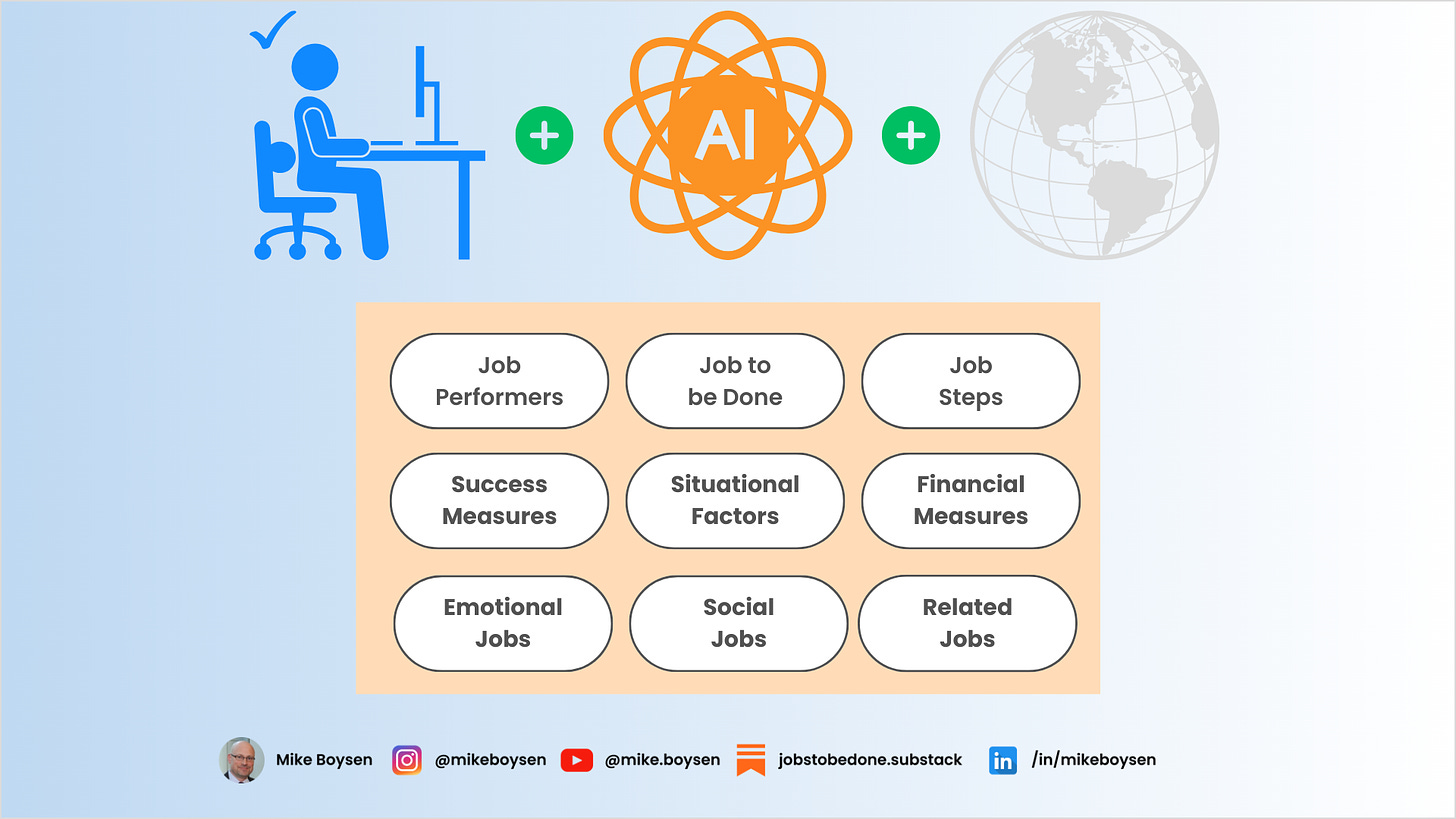

These are typical Jobs-to-be-Done categories. Feel free to adapt and extend.

Top struggle / effort / difficulty

Unmet needs

Unique success measures (rank diff)

Competitive analysis

Derived importance

Willingness-to-pay

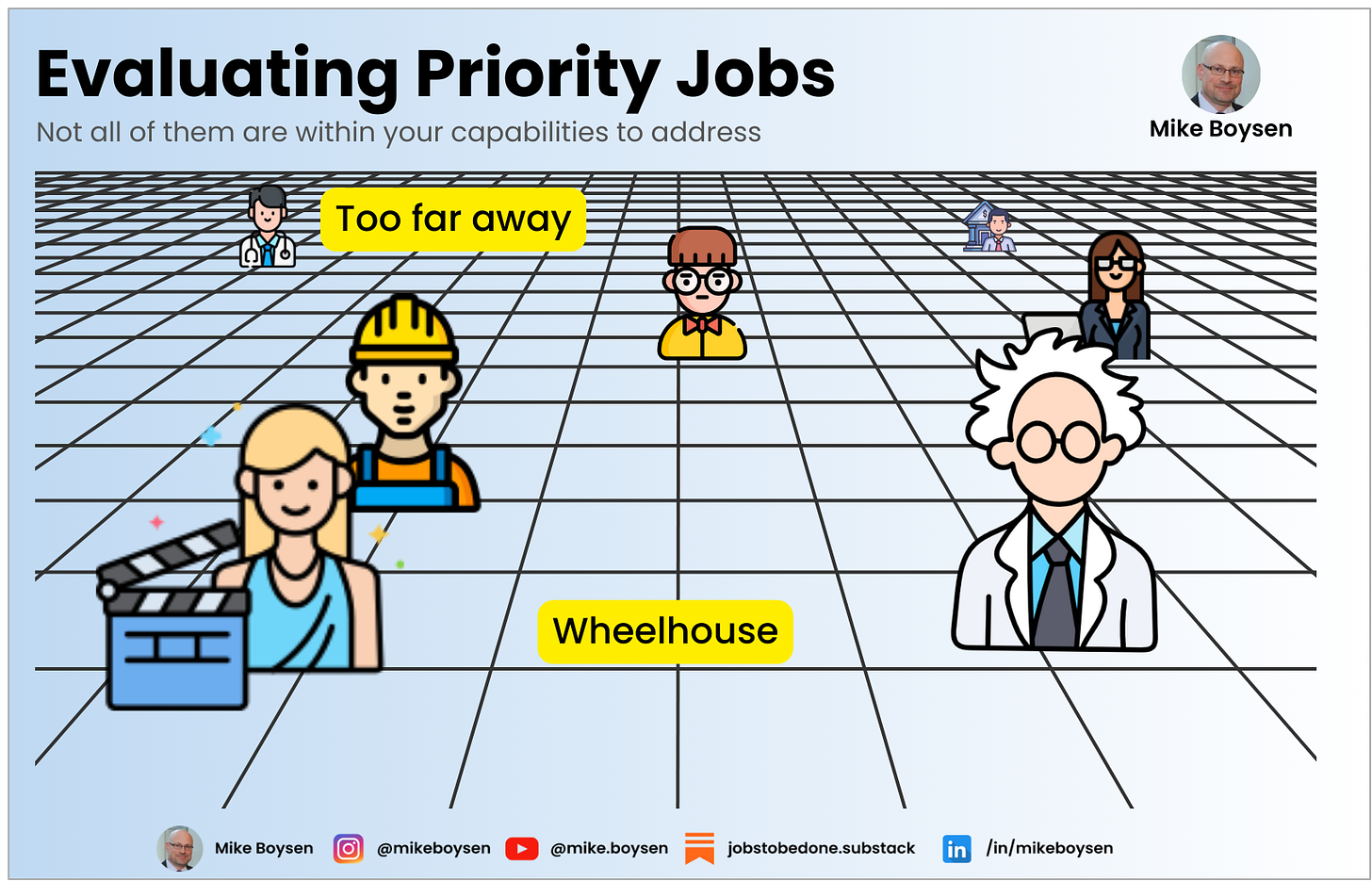

Additional Data Cuts to Produce

If you need to go beyond the basic Jobs-to-be-Done analysis (e.g., needs-based segmentation), you will need to take that into account when determining your sample size. I’m not a statistician, so you can follow their advice and get cuts at n=30. But people tend to have more confidence in larger numbers. Of course, you’ll pay the price.

Segmentation by age and demographic variables

Segmentation by type of plans chosen (e.g., prepaid vs postpaid)

Etc.

Visualizations

We live in a visual world. Most people making strategic decisions don’t want plots of data, they want answers, and the generally want them supported by great stories. So, maybe a story board is the best visualization, supported by the items below, if necessary.

Prioritizations (heatmaps) of customer success metrics

Needs-based segmentation landscape

Prioritization and Segmentation tables

Dynamic dashboards for specific analyses

Formulate Strategies Based on Needs

Identify what types of strategies you want to, or need to formulate based on the reason driving the survey. These are just suggestions.

High-level Recommendation Categories - Marketing and Sales

Target existing offerings at segments and needs

Message existing product strengths

Improve your marketing communications

High-level Recommendation Categories - Messaging

Borrow features from other products

Differentiate with new features

Build out the ultimate platform/channel to get all job steps done

Within One Segment (Unique Opportunities)

Recommendation to address the most underserved need - the metric is underserved by a significant margin

Recommendation to address a group of underserved needs that are thematic - e.g., quality of customer service

Recommendation to address a group of underserved needs that are within a job step - porting of existing number

Recommendation to create a new platform as all needs are underserved - comprehensive self-service portal, or mobile app

Within Multiple Segments (Common Opportunities)

Recommendation to address the most underserved need - .e.g., network coverage (need is underserved by a significant margin)

Recommendation to address a group of underserved needs that are thematic - e.g., cost and billing transparency

Recommendation to address a group of underserved needs that are within a job step - e.g., ease of reaching customer service

Recommendation to address a group of underserved needs that are thematic in one segment, and on the border of another - e.g., device upgrade options

Recommendation to address a group of underserved needs that are within a job step in one segment, and on the border with another - e.g., quality of customer service

Recommendation to create a new platform as all needs are underserved - unified app for all customer needs

Sample Plan

An appropriate sample plan is crucial for the integrity and validity of a consumer survey, serving as the foundation upon which reliable and generalizable conclusions are drawn. A well-designed sample plan ensures that the population surveyed is representative of the larger target audience, mitigating the risks of bias or skewed results.

It outlines key parameters like sample size, selection criteria, and sampling method, which together determine the survey's margin of error and confidence level. Without a carefully structured sample plan, there is a heightened risk of collecting data that is not only misleading but also incapable of addressing the research objectives effectively, thereby compromising the entire study.

There are many sources available that will help you to define a sample plan, so I won’t revisit them here. The following is one way you could describe this to a 3rd party research organization given the example study we’re using.

Overall sample frame

We will survey 1500 adult cell phone users in the USA to rate the desired outcomes they are trying to satisfy when deciding to switch to another telco provider.

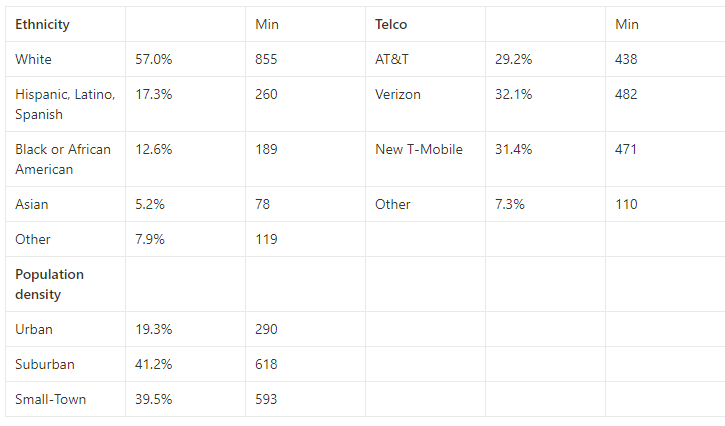

The sample is designed as a random sample with quota groups to ensure representation across subregions of the US, ethnicity, population density, and wireless telecommunications provider.

Consumption job sample minimums: 1500 adult cell phone users

These may not be the dimensions that you want to know about, so feel free to add in your own. What we do know in Jobs-to-be-Done research is that while these may be somewhat helpful for certain marketing activities, customer needs do not break down by these categories. In fact, on average everyone in these groups will appear to be adequately served.

That’s all for this one. There are generally 8-9 sections in a survey, but I will only be covering 8 of them, so 7 more to come.

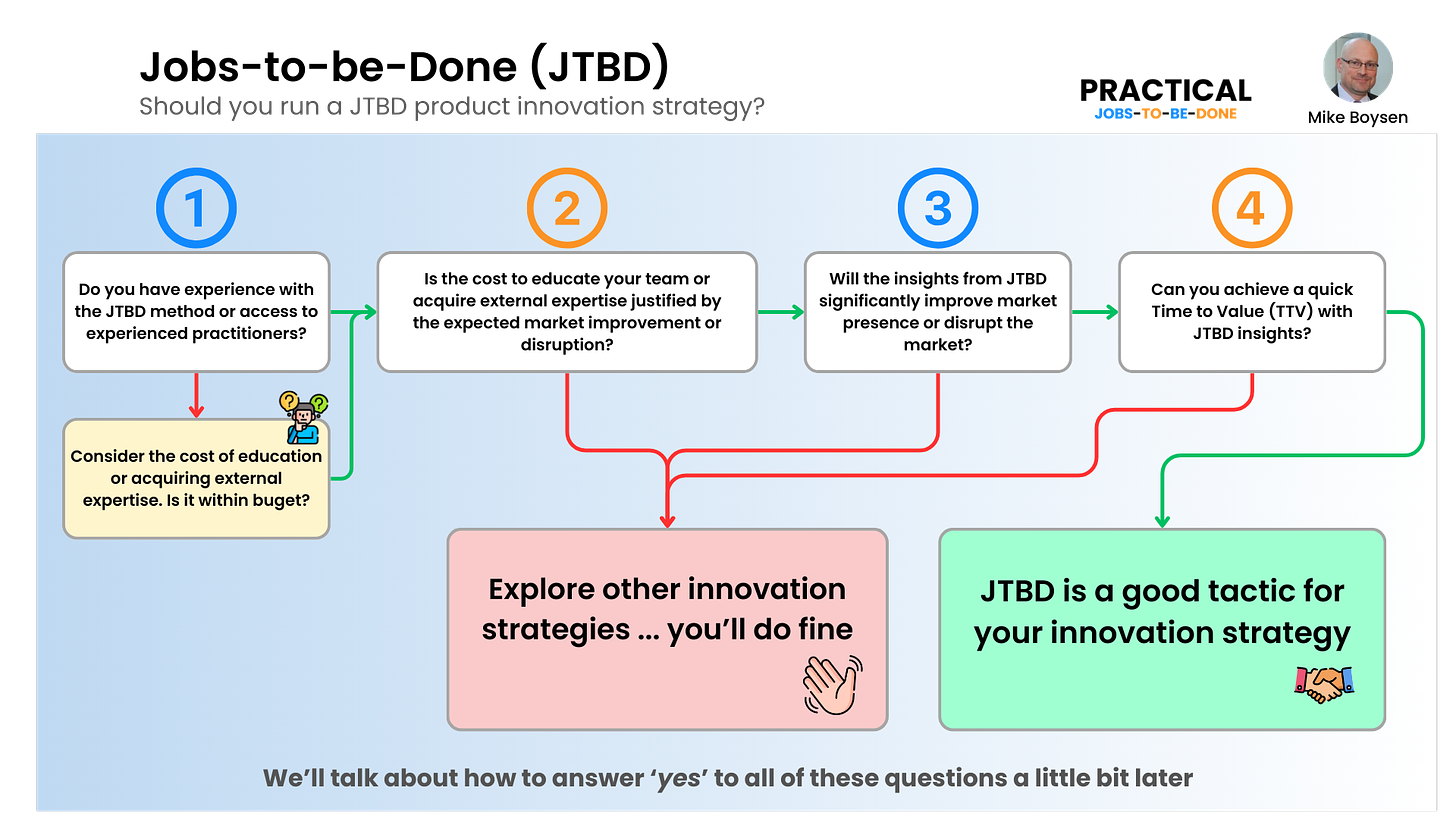

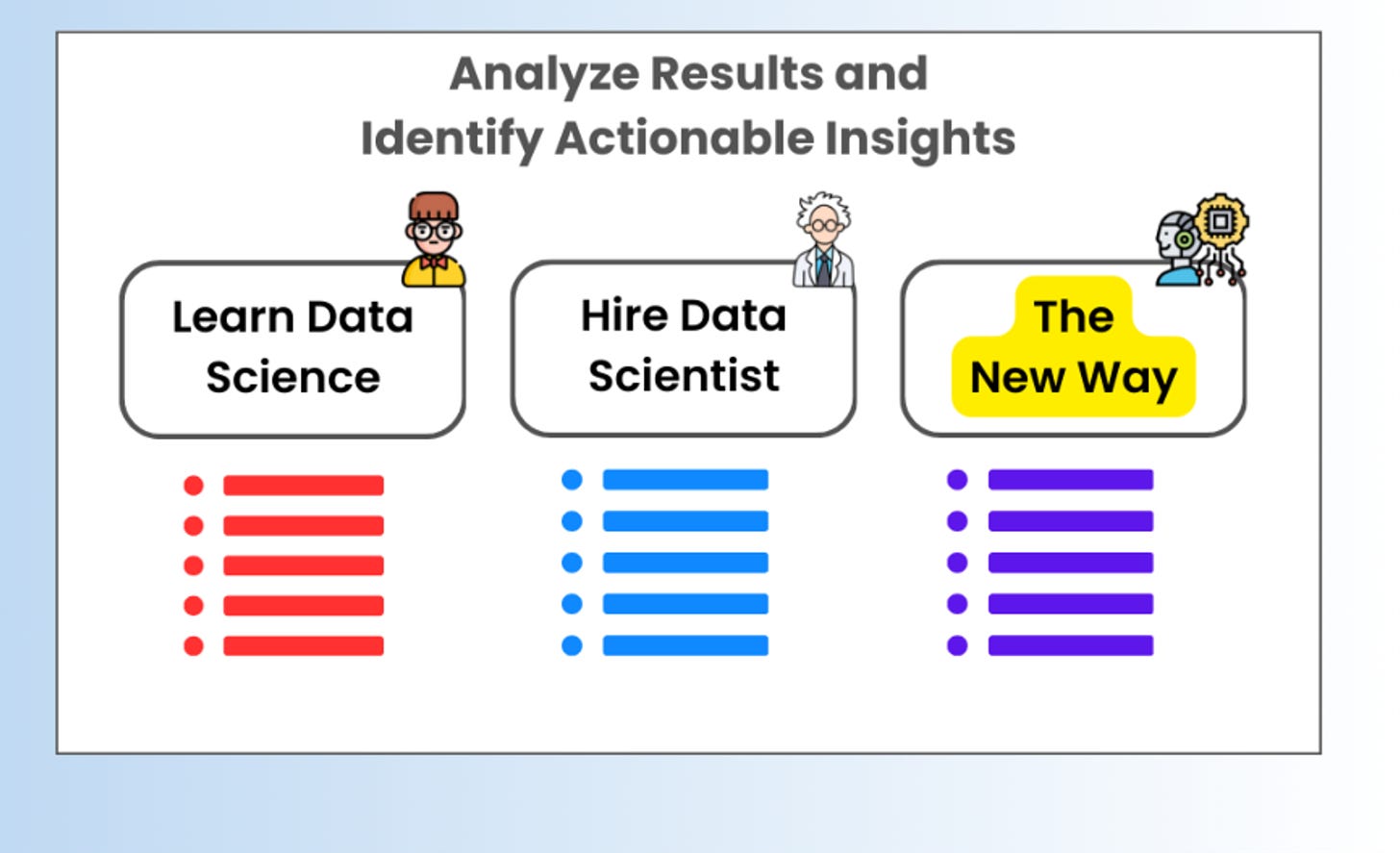

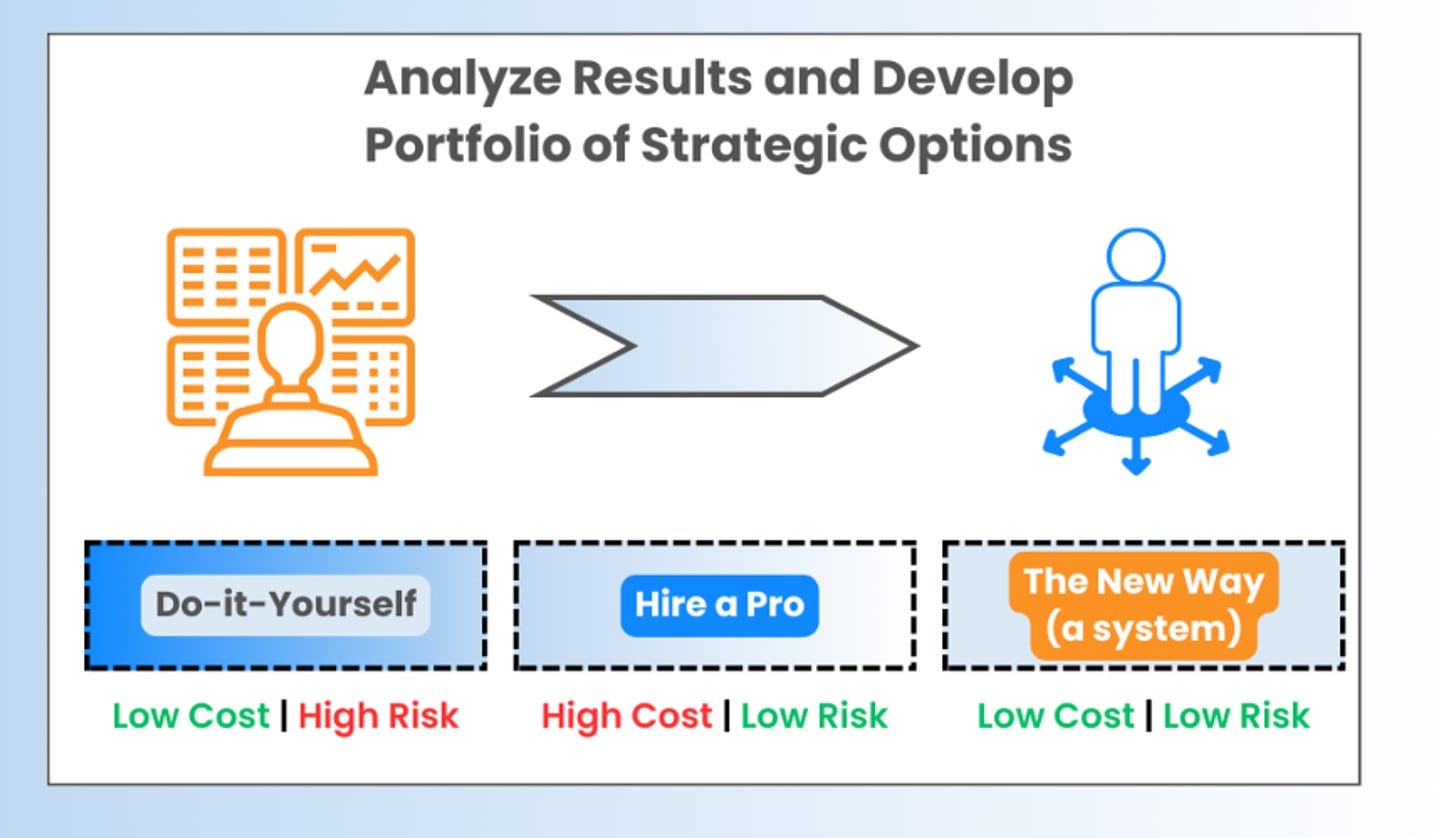

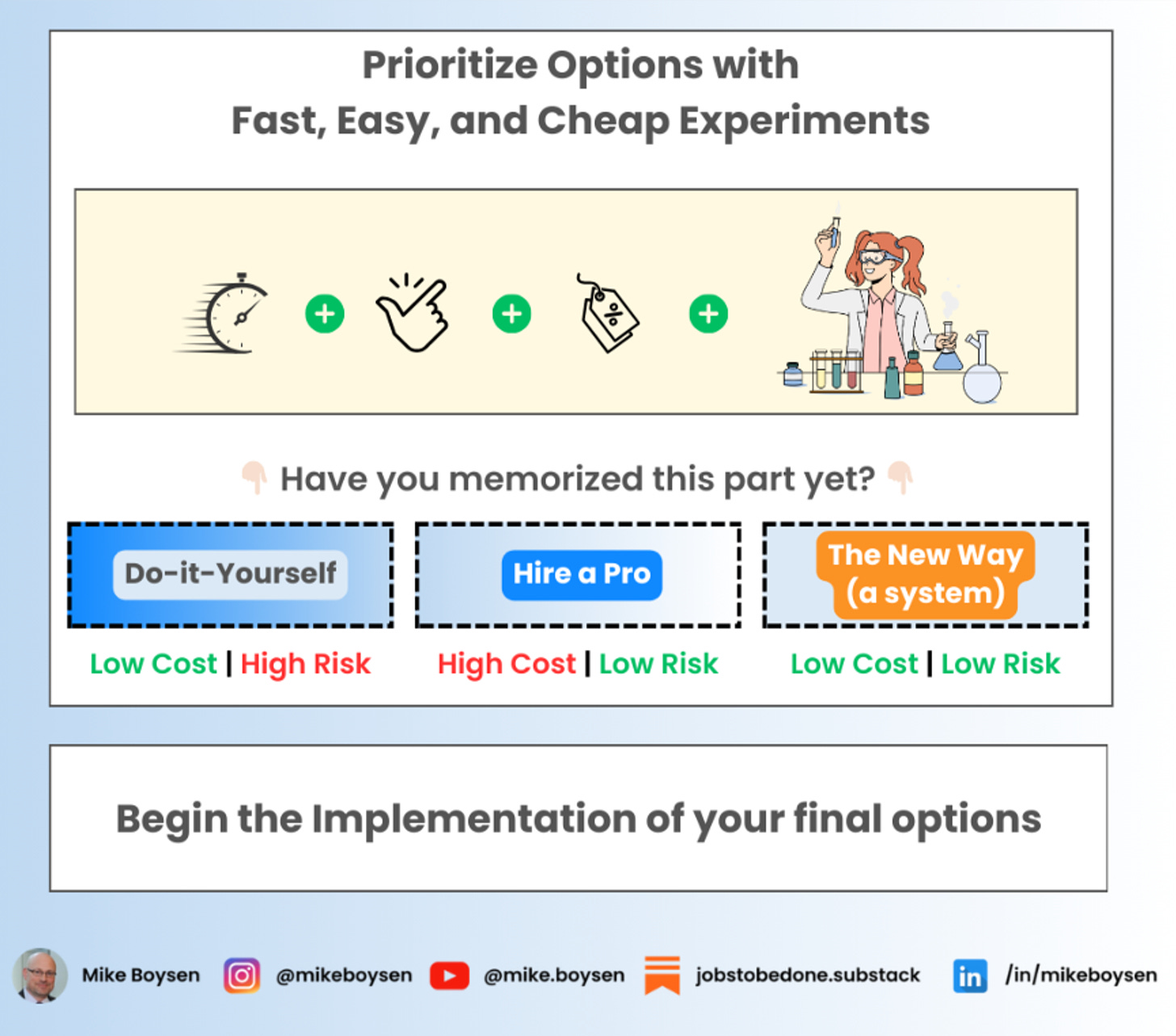

End the Analysis Paralysis

If you or your team is struggling with Jobs-to-be-Done, we’d like to help. We’re leading the way to a better innovation and product development process.

We’re here for companies who don’t want to, or can’t invest in Big ‘N’, or specialty consulting firms and their leveraged resource models.

We’re 20x faster and 10x less expensive than your traditional options because We’ve embraced modern tools and methods that can scale.

We’re not here to engage you with theatrics, We’re here to collaborate and systemize. It’s not about us, it’s about you.

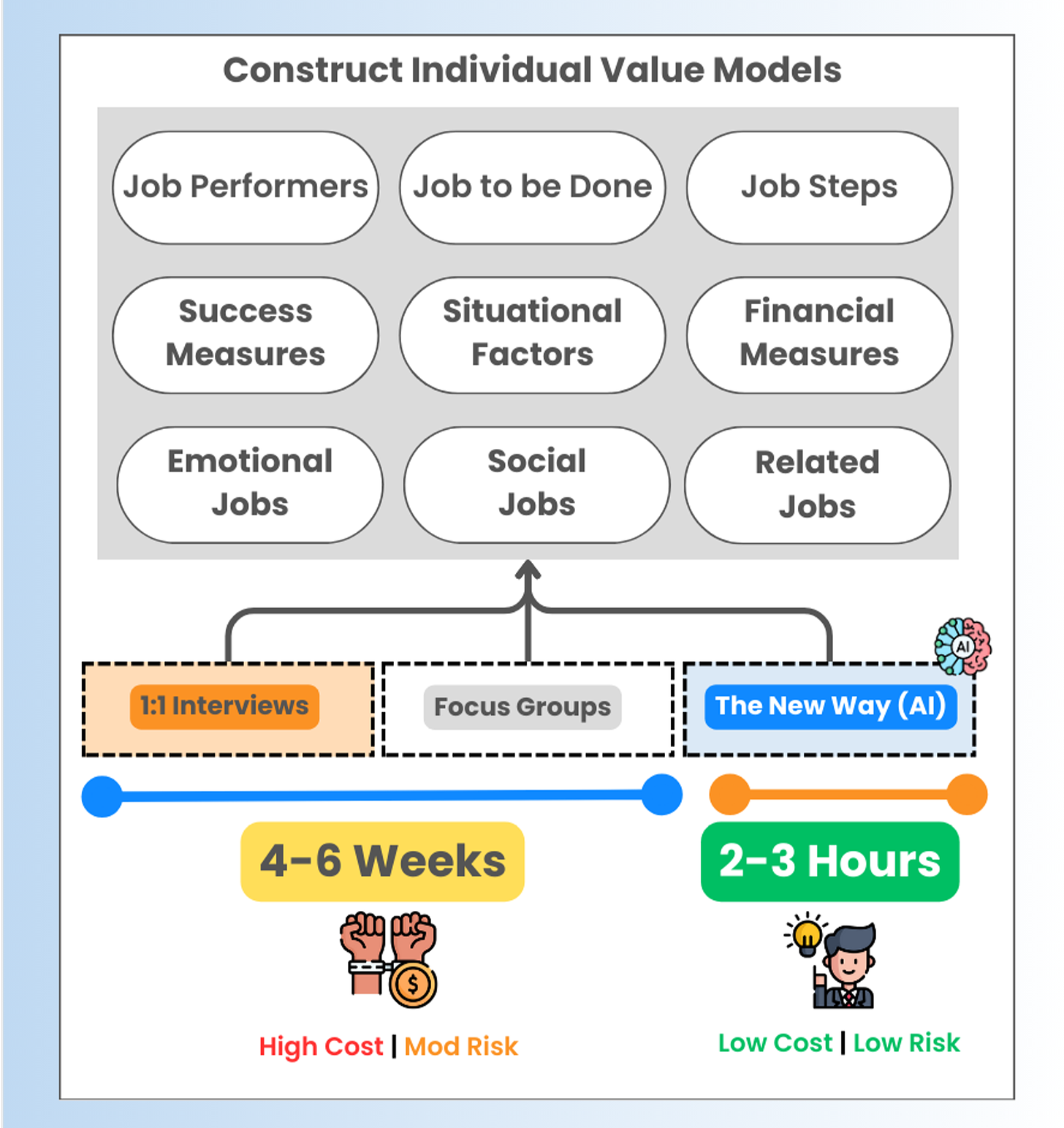

Using our adapted approach to Jobs-to-Done - with a little bit of human experience on top - we can help you to get the insights you need in days and weeks without the need for an army of inexperienced consultants and analysts that add unnecessary cost and deliver static PowerPoint decks.

Qualitative Research - at the speed of light ✅

Quantitative Research - with dynamic leave-behinds ✅

Strategy Formulation - focusing on the top things you should do today ✅

You can reach me at [email protected]